Guidelines for retail investors

Buying an office or retail space is a huge investment, which is why commercial real estate has been traditionally seen as an asset class that only institutional investors or heavyweight HNIs could invest in.

Buying an office or retail space is a huge investment, which is why commercial real estate has been traditionally seen as an asset class that only institutional investors or heavyweight HNIs could invest in.

Unsold, vacant, no takers…these words aptly sum up the story for real estate developers into malls in India. Even though retailers are spreading their wings once again after the slowdown, the absorption of malls remains sluggish, leading to high vacancies.

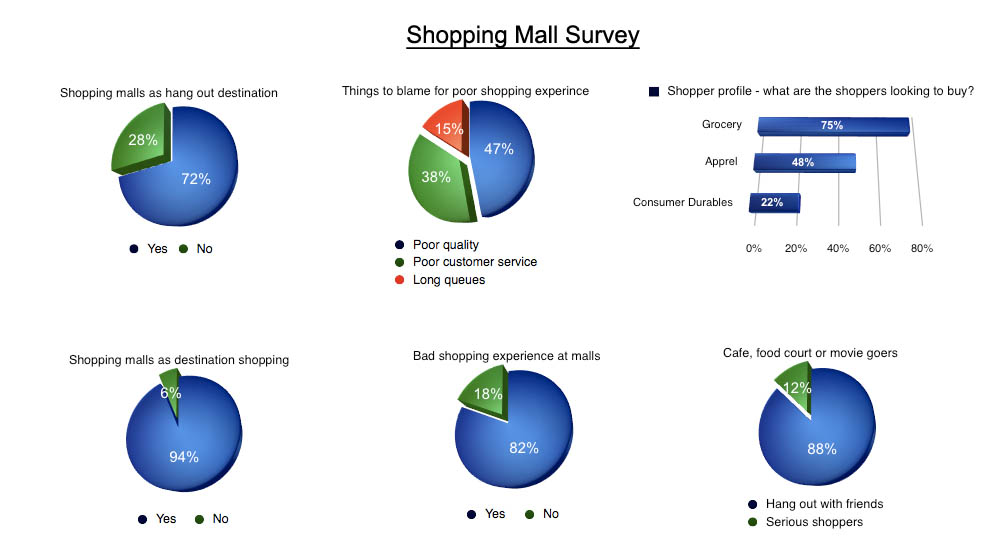

As many as seven out of 10 Indians with disposal income, a whopping 72 per cent, go to shopping malls at least twice a month but don’t buy the monthly food & grocery, apparels or consumer durables over there.

The concept of international, standardized luxury floor space must evolve further before India can absorb the demand. Developers must come up with more imaginative ideas of differentiating their luxury malls from the run-of-the-mill.

A mammoth increase in planned supply of retail malls in India will increase retail companies’ bargaining power vis-à-vis real estate developers.

Urbanization rate is on the increase – and while there had been a few setbacks over the past few years, the Indian luxury retail market is firmly back now. The economy once again supports the rationale for spending on luxury goods, and it will continue to do so.

For the third consecutive year, Jones Lang LaSalle was awarded the ‘International Property Consultant Of The Year’ Award at the Asia Retail Congress for Excellence in Retail, held on 8–9 February 2011 at Hotel Taj Land’s End in Mumbai. Jones Lang LaSalle India won the award by a landslide, beating all other competing international property consultants.

With the provision of more entertainment options in malls, Indian retailers now have vastly enhanced their ability to increase sales. Until recently, street markets and bazaars were the top performers in the retail space, and they were cornering a huge chunk of the overall sales.

Equity capital inflows touched USD 8.9 billion between January and September, registering a 46% Y-o-Y growth. The strong momentum in deal volume continued, with about 200 deals reported during this period, compared to 151 deals in the same period last year. The average deal size also increased to nearly USD 45 million in the first nine months of 2024 from about USD 36 million in 2023. Mid-sized deals, ranging between USD 10-50 million, represented 56% of the total investment inflows during this period.

India continues to exhibit strong economic growth prospects and business optimism is reflected in the increasing number of Initial Public Offerings (IPOs) in recent years. The traction in the number and volume of public issues lends credibility to an environment of higher corporate earnings, rising participation by retail and institutional investors, and availability of adequate liquidity in the market. With 123 fresh issues (As of 20th October 2024) across multiple sectors, 2024 has already surpassed the total number of IPOs witnessed in 2023.