Realtors sulk under representation in budget

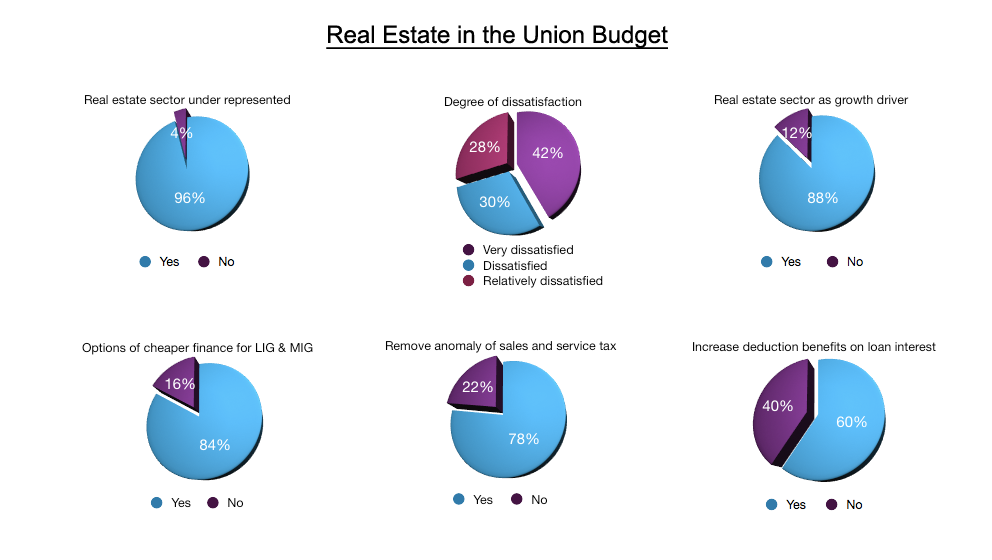

Nearly all the real estate developers, a whopping 96 per cent, across the country are cribbing for the sectors’ continued under representation in the Union Budget over the years.

Nearly all the real estate developers, a whopping 96 per cent, across the country are cribbing for the sectors’ continued under representation in the Union Budget over the years.

Public sector banks including State Bank of India, Bank of Baroda, Bank of India, Indian Overseas Bank have served notices to dozens of real estate companies to recover around Rs 20,000 crore of their exposure by March.

Nitesh Estates has announced the launch of a Rs-100 crore luxury residential project in Bengaluru. The project, Nitesh Logos, would be located in the central business area MG Road and provide all modern amenities, company officials said. The project is expected to be completed in two years.

Nitesh Estates Limited has announced impressive performance for the third quarter ended on December 31, 2010 with a Consolidated Total Income of Rs. 31.8 Crore; EBIDTA of Rs 4.03 Crore & PAT of Rs. 2.58 Crore.

THE CBI interrogation of DB Realty’s MD, Shahid Balwa, in connection with the 2G spectrum scam has thrown up the possibility of the real estate magnate having links with India’s most wanted man, Dawood Ibrahim. According to senior CBI officials, Dawood invested large sums of money in Balwa’s firm, which was used by him to finance many of his business deals.

If you are living as a tenant in Mumbai and seeking to buy a house this year, there seem to be quite a few confusions going around. While some of the reports and projected forecasts may give you a ray of hope, it would rather mislead you and your wait for a cheaper home may actually cost you to pay more in future.

The RBI and market regulator SEBI have enhanced their vigil on funds coming from Mauritius, suspecting round-tripping or routing of illicit money back through the island nation.

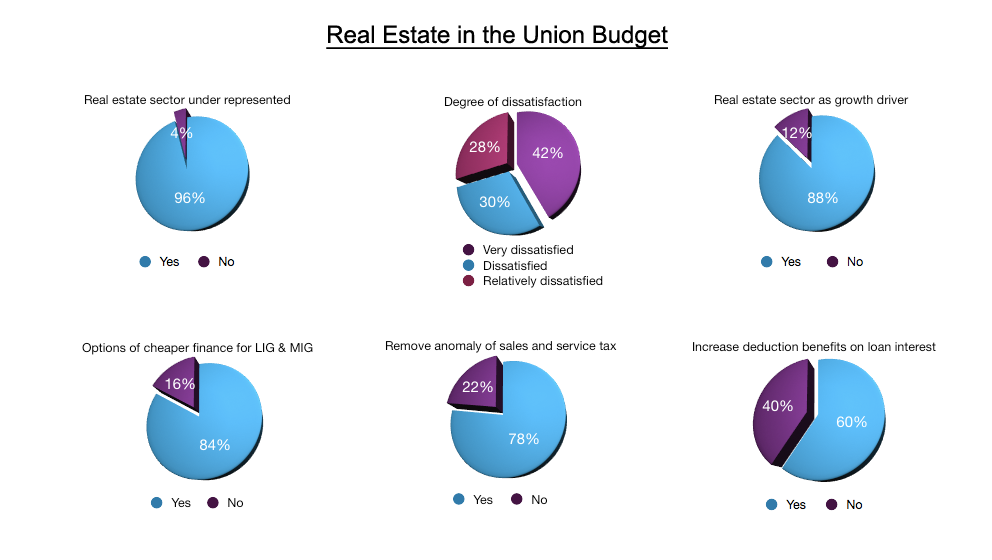

Real estate developers have called for focussed support in the Budget for the first-time home buyer and measures to augment supply of housing for affordable and low income groups. Industry representatives have also called for a simplification of systems and tax reliefs as a step to bringing down costs and catalyse developments.

I am relatively dissatisfied with the budget focus on the sector as no efforts made to the growth of the sector. My wish list to the Finance Minister is to relax the provisioning norms of banks for Real Estate loans, sector status to real estate, clarity on service tax & VAT, with some relaxation and to increase the interest exemption on Housing loan. But then the Finance Minister has not consulted the industry representatives in the last few years.

Value and Affordable housing remains a segment where government should definitely continue to provide developers with tax free status which was available earlier. Rather than restricting it to unit sizes as in the past of 1,000 / 1,500 sft per housing unit, the government could instead have a maximum per unit value of say Rs. 15 lakhs for units near Tier I Cities, Rs. 10 lakhs for Tier II Cities.