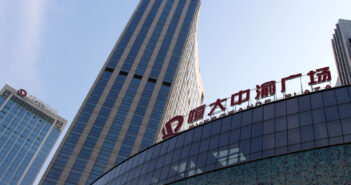

Evergrande and the unlearnt lessons of Indian real estate

Within the built environment of the Indian real estate there is still denial about too many parallels between the Indian and the Chinese real estate. Many even believe that the Indian economy is not that real estate dependent as the Chinese economy. Even when admitting the crisis in Indian real estate, it is diplomatically wrapped in the developer’s justification of not learning any lessons on part of the Indian developers.