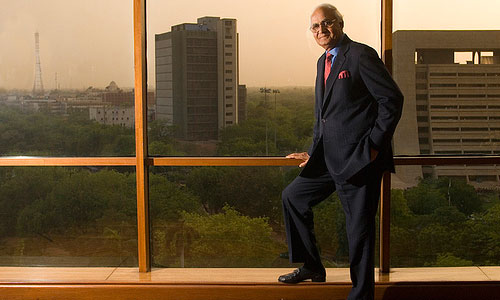

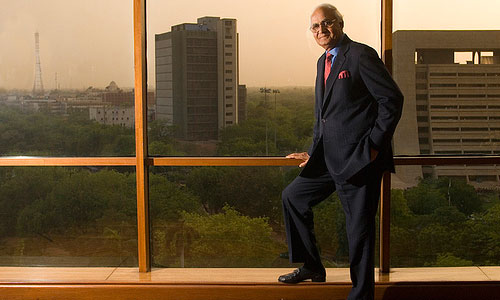

Don’t stunt real estate growth: DLF Chairman KP Singh to RBI

DLF’s Chairman K P Singh has said that RBI’s monetary policy should not stunt the growth of real estate sector and uninterrupted access to affordable finance is vital for this business.

DLF’s Chairman K P Singh has said that RBI’s monetary policy should not stunt the growth of real estate sector and uninterrupted access to affordable finance is vital for this business.

American property mogul Donald Trump’s maiden real estate project in the country, being developed by Pune-based Panchshil Realty, has been launched.

The Union cabinet may introduce the final version of the much awaited Land Acquisition, Rehabilitation and Resettlement Bill in the monsoon session of Parliament. Earlier, the ministry had sought suggestions and recommendations from other ministries and government agencies on various provisions introduced in the Bill.

Industry bodies like NAREDCO can become ideation centers. NAREDCO is actually taking some concrete steps in getting the consumers and developers to connect with the policy makers. Ideally, we need to identify the next line of growth centers. Every city will have its own growth center. That is when we can realise that the consumer is buying what he wants and not what is available.

The institutional projects in India are normally working in a PPP model because such projects have long payback periods and require large capital investment. Further, they are large in size and hence require number of approvals, making Government participation relevant to secure initial approvals, clearances and get the project going.

The RBI, on Tuesday, July 31, kept the repo rate or the rate at which banks borrow from RBI unchanged at 8% and also the reverse repo rate at which, the banks lend to RBI unchanged at 7%. However, it has lowered the statutory liquidity ratio (SLR) to 23% from 24% earlier. The realty sector, reeling under liquidity pressure and low demand due to high interest rate, has reacted sharply over this status quo.

Despite buyers’ expectations of a likely fall in city property prices, this possibility seems limited as developers continue to hold on to their prices across sub-markets on the back of the DCR amendment. This policy, along with the increase in construction costs, has led to greater pressure on developers’ margins. Post the new DCR, the saleable areas are expected to reduce and carpet areas are likely to increase. It is interesting to note that while there have, in fact, been marginal price increases across many projects in MMR, registration data reflects that absorption levels have also increased.

The Union Cabinet is expected to consider the Real Estate (Regulation and Development) Bill within a fortnight. However, while the Government intends to present the Bill during the monsoon session of Parliament, scheduled to start from August 8, single window clearance to the projects is the only stumbling block in its way.

Pune has been a favoured industrial destination for a very long time. In fact, manufacturing has been a major development focus for the city since the inception of PCMC in the 1960’s. Since then, there has been a massive influx of European companies who were and continue to be keen on setting up manufacturing facilities there.

The Hinduja Group, with a global presence in core sectors such as oil and gas, automotive, power, IT, banking and finance, today announced a major foray into the real estate sector in India involving an investment of up to $15 billion.