DLF plans to lower debt to Rs 17,000 cr

DLF on Sunday, July 15, said it planned to cut its Rs 23,000-crore debt to about Rs 17,000 crore in this financial year and asserted that it was not unduly “perturbed” by the massive load.

DLF on Sunday, July 15, said it planned to cut its Rs 23,000-crore debt to about Rs 17,000 crore in this financial year and asserted that it was not unduly “perturbed” by the massive load.

Lanco Infratech Ltd, the power producer, is reportedly seeking buyers for a real estate business it values at 27 billion rupees ($483 million). According to the sources close to the development the company has asked investment banks to submit proposals to manage the sale.

During the boom, many developers dreamed of transforming the urban landscape with millions of square feet of homes, offices and malls and set off on an aggressive expansion financed with debt that at 6 percent interest was cheap by Indian standards.

Realty sector may appear to be bullish and project that downside is over with rosy forecast ahead, yet the decline in fortune is far from being over. As a matter of fact, the learning in the last four years has made most of the leading players to restructure their project portfolio and shed the flab.

Revenues of top-25 realty companies declined 9.30% in Q4FY12, mainly on account of low sales off-take due to higher prices and higher mortgage rates, says a Knight Frank India Research on Economy and Realty at glance. The study says the Realty Index on Bombay Stock Exchange (BSE) has dropped by more than 26% during the last one year compared to a 10% fall in the Sensex during the last fiscal year.

DLF, has sold its entire stake in Adone Hotels and Hospitality Limited (Adone) to Kolkata-based Avani Projects and Square Four Housing & Infrastructure for Rs 567 crore. This was in line with its strategy of divesting non-core assets to pare debt, DLF said in a statement.

Indian real estate companies, which borrowed heavily during the peak of the economic cycle and rosy business forecast, are now caught in the vortex of piling debt post-slowdown. Most of the realtors who went on a land bank acquisition with borrowed money are struggling to repay even the interest and banks look reluctant to restructure the debt any more.

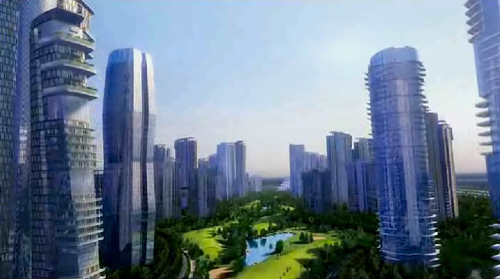

Over the last year, there has been an unequivocal crystallization of Indian cities that continue to attract serious investment into real estate. This is directly correlated to the economic dynamics now working in the country. If India is to achieve even a conservative GDP growth of 6% per year, it emerges that only three cities – Mumbai, Delhi and Bangalore – have the potential to deliver. The reason for this is that close to 2/3rd of the overall development of office space in the country is now taking place in Mumbai, Delhi and Bangalore.

When the Finance minister Pranab Mukherjee proposed home buyers to withhold 1% of the sale consideration as Tax Deducted at Source (TDS), it became a free-for-all kind of football match with developers and property consultants alleging that it could encourage black money component in real estate, while tax consultants believed otherwise and pointed out that the reach of the banking sector in rural area makes it easier to detect unsavoury deals.

In the coming months, the pressure will be to reduce debt-to-equity ratios. With so many developers in debt already, the industry is trying to come out of the situation and 2012 will not be much different. It won’t be easy and the developers are trying various routes. Selling of developed projects, vacant land is a route taken by many developers. Several developers are now providing attractive terms to PE funds to securing funding.