Realty sector foresees black Diwali post repo rate hike

The repo rate hike by the Reserve Bank of India (RBI) by 25 bps seems to have spoiled the festive spirit of the real estate sector.

The repo rate hike by the Reserve Bank of India (RBI) by 25 bps seems to have spoiled the festive spirit of the real estate sector.

While the real estate carries home the point that the very nature of business has gone for a change with second generation taking over the business, professionals driving the show and efforts for an overall image makeover.

DLF has sold a 28-acre plot in Gurgaon to M3M India for Rs.440 crore, in the first among many such big-ticket sales it has lined up this fiscal to bring down mounting debt.

Global consultancy firm McKinsey has recommended moving Indian household savings in physical assets like gold and real estate to financial assets to increase the flow of financial savings to domestic equity markets.

Jaiprakash Associates (JPA), the Jaypee Group flagship, is on the look out for a strategic partner for its cement business, the third largest in the country.

A study by international property consultants Knight Frank finds real estate prices in India have risen by 21.3 per cent over the past one year, making it the country with the second highest rise in real estate prices globally.

Villas are a unique product because unlike in apartments, the buyer gets to own the piece land on which the villa is built.

A report by real estate firm Knight Frank says worldwide mainstream house prices marginally avoided falling into negative territory with prices rising on average by 0.1% in the three months to June 2011 and by 1.7% over a 12-month period.

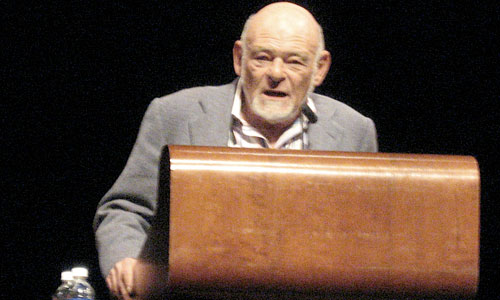

Billionaire Sam Zell said he is entering the real estate markets in Colombia and India in the next two weeks as he continues to favor international investments over U.S. property deals.

The only constant is change. This has been an axiomatic truth for the Indian real estate market over the last 24 months, with volatility having become a byword to describe it.