DLF to cut debt by Rs 5,000 crore by selling three non-core assets

DLF on Tuesday, Aug 7, said it expects to close sale of three non-core assets, which will help pare its debt by about 5,000 crore, by the end of the current fiscal.

DLF on Tuesday, Aug 7, said it expects to close sale of three non-core assets, which will help pare its debt by about 5,000 crore, by the end of the current fiscal.

Jones Lang LaSalle global property update for Q3 2012 shows edges towards recovery. It has released its quarterly Global Market Perspective, which captures in-depth data and analysis on the global property market in the year to date.

India emerged as the second most risk ridden Data Centre Location among the top 30 countries in a study conducted by Cushman & Wakefield and hurleypalmerflatt. The pioneering study ‘Data Centre Risk Index’ evaluated the risks to global data centre facilities and international investment in business critical IT infrastructure.

Shares in DLF, India’s biggest real estate developer, traded higher in-line with the broader BSE realty index Tuesday, Aug 7, morning. At 11 a.m., the stock traded 1.3 per cent higher at Rs 214 on the BSE. The shares, up 15.4 per cent this year, are lagging a near-21 percent gain in the real estate index.

Money generated through illegal means is laundered through various means including real estate and election campaigns in India, a report of the US State Department has said.

Jones Lang LaSalle’s REIS findings are in, and a closer look at the 1H12 data reveals relatively subdued activity during the period compared to 1H11. In 1H12, the top seven cities of India together recorded a 35% dip in absorption compared to 1H11. The contraction in demand caused developers to progress more slowly on their projects thereby aligning the supply with demand.

The RBI, on Tuesday, July 31, kept the repo rate or the rate at which banks borrow from RBI unchanged at 8% and also the reverse repo rate at which, the banks lend to RBI unchanged at 7%. However, it has lowered the statutory liquidity ratio (SLR) to 23% from 24% earlier. The realty sector, reeling under liquidity pressure and low demand due to high interest rate, has reacted sharply over this status quo.

Despite buyers’ expectations of a likely fall in city property prices, this possibility seems limited as developers continue to hold on to their prices across sub-markets on the back of the DCR amendment. This policy, along with the increase in construction costs, has led to greater pressure on developers’ margins. Post the new DCR, the saleable areas are expected to reduce and carpet areas are likely to increase. It is interesting to note that while there have, in fact, been marginal price increases across many projects in MMR, registration data reflects that absorption levels have also increased.

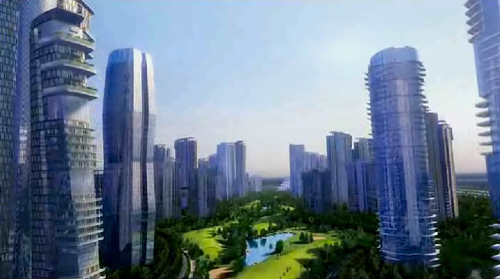

Pointing out that real estate development can revive the sagging economy, developers’ apex body CREDAI has called for launching a mission to make India Housing Surplus from the current status of a housing deficit nation by 2020.

Beyond what is happening in the strategic board room meetings of realty companies, market is cautiously optimistic that with the inventories piling up, developers will sooner or later be forced to blink. A look at the recent developments in the sector does indicate that prices can come down, but it all depends on the builders holding power.