Hiked interest rates – Impact on the real estate sector

It has always been axiomatic that when financial institutions raise their lending rates, there are bound to be ripples on the highly cost-sensitive Indian real estate market.

It has always been axiomatic that when financial institutions raise their lending rates, there are bound to be ripples on the highly cost-sensitive Indian real estate market.

Indian arm of a leading Bangkok based developer is looking to invest some $300 million in the country’s real estate market, particularly in the major cities of Delhi, Mumbai and Bangalore.

After recording significant leasing in 4Q10, Mumbai city witnessed moderate transaction activity in 1Q11 as the major office occupiers of India Inc awaited the impact of budget on their corporate real estate strategy for the next fiscal year.

The period ending 1Q11 witnessed moderate activity in the office market in the city. With CBD vacancy rates continuing to hover at around 1%, office transactions were limited to either small office queries or larger office spaces that were inevitably a churn in the existing stock.

The bullion company, Goldsukh Trade India Limited has now entered into real-estate estate.

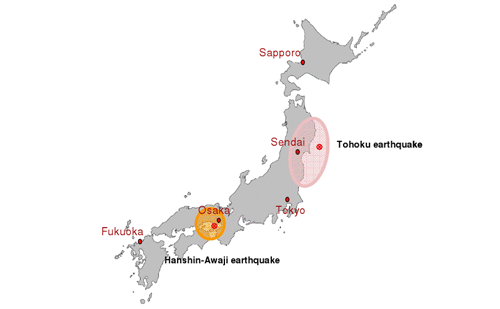

On 11 March, a major earthquake and tsunami hit Eastern Japan. According to official statistics, the number of deceased had surpassed 13,000 as at 14 April.

The Sensex has always been a barometer of the country’s general economic ‘mood’. The real estate index, on the other hand, is an indicator of the sentiments towards real estate developers.

Indiabulls Real Estate Ltd said on Friday its promoter group companies have increased their stake to 25.57 percent in the firm by acquiring shares from the open market.

Unsold, vacant, no takers…these words aptly sum up the story for real estate developers into malls in India. Even though retailers are spreading their wings once again after the slowdown, the absorption of malls remains sluggish, leading to high vacancies.

While real-estate and property advertising in India has been mostly lacklustre, a new campaign by Mumbai-based realty developer Oberoi Realty has broken the mould.