An open letter to Mumbai’s commercial space developers

We are looking at a potential situation in Mumbai’s office…

We are looking at a potential situation in Mumbai’s office…

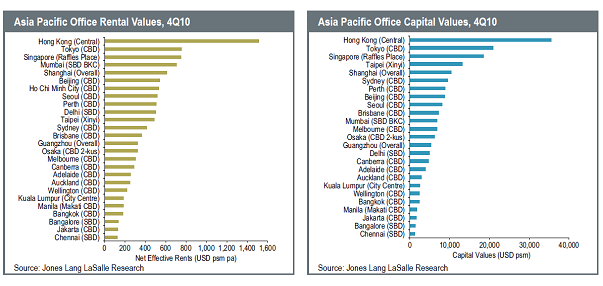

New research from Jones Lang LaSalle reveals that positive business sentiment and solid corporate hiring are buoying leasing demand in the office markets of Asia Pacific. In 2010, aggregate net take-up across major Tier I markets was more than double the level of the previous year.

AI & Robotics companies accounted for 21% of Bengaluru’s absorption in Q2 2024, as per Vestian’s quarterly office market report, The Connect Q2 2024. Rapid global advancement of artificial intelligence, combined with a supportive ecosystem, has significantly driven the demand for office space in the city. Overall, IT-ITeS sector, including AI & Robotics, accounted for 69% of the city’s absorption in Q2 2024.

Worsening the situation at a frightful angle is the global pandemic attack, which led governments to struggle with the new lockdown measures and brought big shifts in the stock markets. Its aftermath will be one of the biggest business challenges of our time – “will employees re-enter the office space?” Workers are concerned about the disinfection strategies being used by commercial complexes.

The factors supporting Bengaluru’s top rank include the city’s high long-run economic growth, high availability of office space, and large talent pool. As per Colliers Research, Beijing and Hyderabad as attractive alternatives, and Hong Kong emerging as a potential new option.

Bhumika Group is also developing a shopping mall, high-street retail and office space and serviced apartments in the first phase. The company is giving retail space in shopping malls on lease, while office space, high-street retail and service apartments are on sale model.

The greener pastures are mostly defined with numbers and not execution capabilities or business model. For example, the absorption of office space has been upwards of 40 million square feet per annum for the last 3 years. The overall sentiments in this segment look bullish with PE investors also putting in money. As a matter of fact, even in retail real estate the PE investors are bullish and exploring even the Tier II cities having malls with good footfalls, brand mix and strong sales. This is what is enticing the residential developers looking for both the buyers as well as the capital investments.

While 2018 lived up to a fair number of expectations, there were a few misses too, particularly in the case of clarity on GST norms. Key highlights of 2018 were the creation of positive sentiments in the market by way of a robust office space absorption by emerging segments, as well as increase in the number of new launches and sales in the affordable housing sector.

While Bengaluru tops the charts, Hyderabad has been ranked number 7 and makes a surprise entry, scoring highly on long-run growth potential, although it scores less on other socio-economic factors and does not yet match Bengaluru as a source of talent. As per Colliers Research, about 56 million square feet (5.2 million sq m) of office space, Hyderabad is only about 40% of Bengaluru’s size. However, development is proceeding apace, with total stock set to increase by 33 million sq ft or 60% by 2021.

Track2Realty rates this project as Grade A+. The project promises to be a trendsetter in Hyderabad that is expected to be the next growth driver of office space consumption in India. There are some more ambitious commercial projects coming up in the vicinity, but the developer Salarpuria Sattva will always have an edge with its first mover advantage in creating a futuristic project.