Asia Pacific office markets resilient but not immune to euro crisis: DTZ

Asia Pacific office markets may be resilient but definitely not immune to the euro crisis, says the latest report of DTZ.

Asia Pacific office markets may be resilient but definitely not immune to the euro crisis, says the latest report of DTZ.

I was recently asked about the role IT has played and will continue to play in the demand for high-end housing in Bangalore.

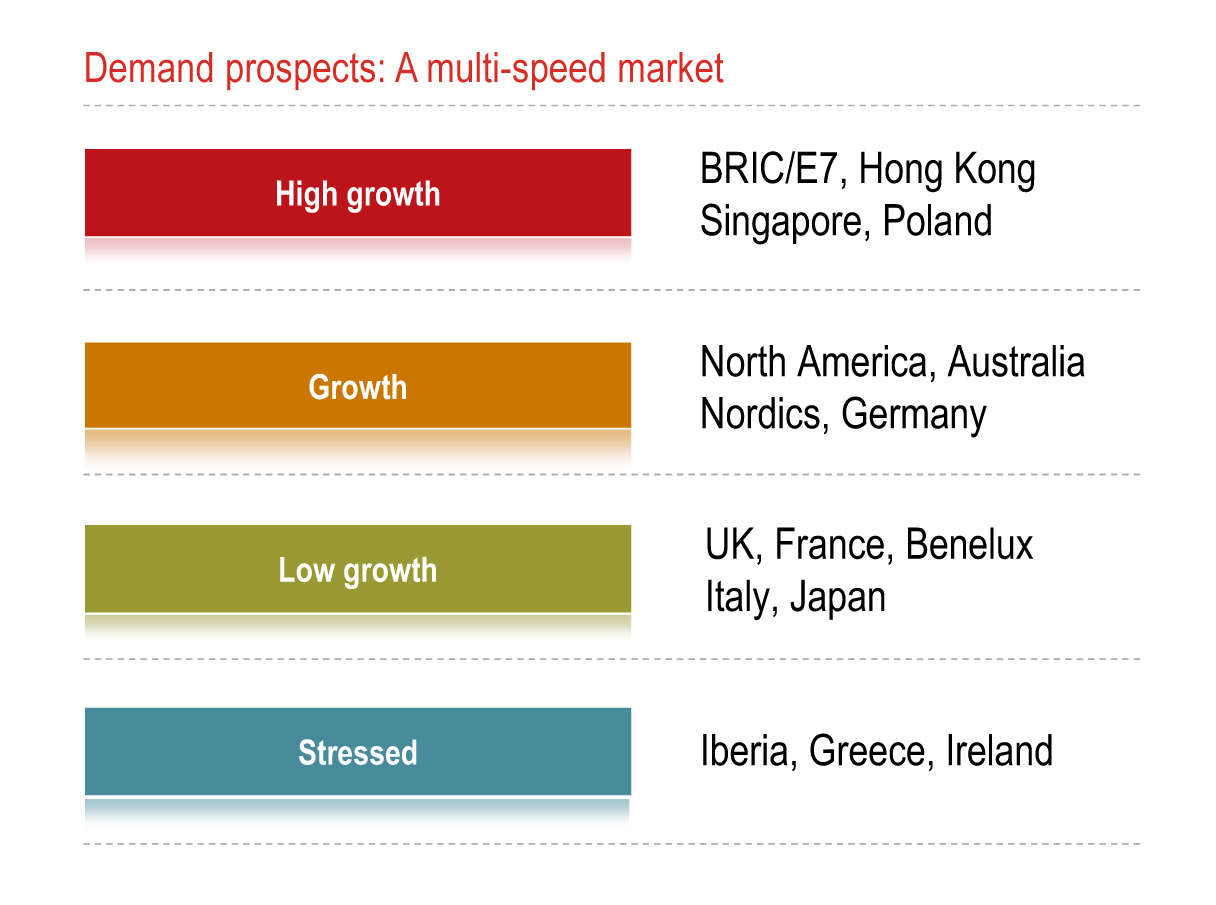

Corporate confidence is boosting activity in top tier office markets around the world, leading to accelerating early cycle rental growth and robust capital value growth in prime assets, especially where new quality supply is limited, according to Jones Lang LaSalle’s inaugural, quarterly Global Office Outlook report.

If you are living as a tenant in Mumbai and seeking to buy a house this year, there seem to be quite a few confusions going around. While some of the reports and projected forecasts may give you a ray of hope, it would rather mislead you and your wait for a cheaper home may actually cost you to pay more in future.

After one and a half years of gradual consolidation, real estate in India has fathomed its own comfortable ground, and is poised at the right threshold to take a giant leap in years to come, according to the forecast of the Jones Lang LaSalle, the global real estate services firm.

Today, the world sees India as a land of opportunity for business and investment. RBI head Raghuram Rajan said in mid-September that while fellow BRICs have deep problems, India appears to be an island of relative calm in an ocean of turmoil.

What appears to be the bane of retail, whether organised or neighbourhood, has been spotted by some innovative entrepreneurs, of late. They are the tech savvy smart players in the segment who have realised that instead of getting into “dog eats dog” competition, it is better to spot the gaps that the upwardly mobile discerning consumers are finding and bridge the trust deficit in retailing to cater to this segment.

Equity capital inflows touched USD 8.9 billion between January and September, registering a 46% Y-o-Y growth. The strong momentum in deal volume continued, with about 200 deals reported during this period, compared to 151 deals in the same period last year. The average deal size also increased to nearly USD 45 million in the first nine months of 2024 from about USD 36 million in 2023. Mid-sized deals, ranging between USD 10-50 million, represented 56% of the total investment inflows during this period.

As the education sector evolves, factors such as technology permeation, revamped building designs, and focus on health & safety are likely to define education real estate. Besides, modern educational building design must prioritise flexibility so that spaces can be reconfigured to adapt to various teaching methods and activities, developing a dynamic learning environment. To address this and move away from traditional classroom setups, educational buildings now include collaborative spaces to encourage teamwork and group learning. Moreover, sustainable, and eco-friendly design elements, such as energy-efficient systems and natural lighting, are becoming increasingly common to reduce the environmental impact of educational buildings.

The surge in demand for luxury housing has been primarily attributable to a growing preference among affluent buyers for enhanced amenities and more spacious living areas that complement their multifaceted lifestyles. Moreover, the increasing aspirational class has significantly contributed to the increased demand for luxury properties. Furthermore, the rise in NRI and astute domestic investors in the Indian real estate market has considerably fueled the heightened demand for luxury residences.