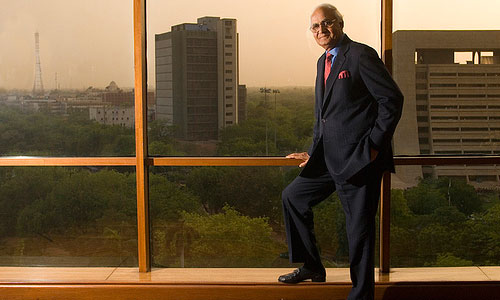

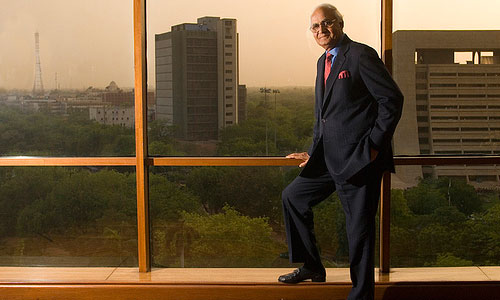

Don’t stunt real estate growth: DLF Chairman KP Singh to RBI

DLF’s Chairman K P Singh has said that RBI’s monetary policy should not stunt the growth of real estate sector and uninterrupted access to affordable finance is vital for this business.

DLF’s Chairman K P Singh has said that RBI’s monetary policy should not stunt the growth of real estate sector and uninterrupted access to affordable finance is vital for this business.

India has launched more than a dozen new skyscrapers taller than 240 meters (787 feet) and it seems the country stands out as the destination next for the skyscrapers. The Indian market is emerging as the happy hunting ground for various specialised service providers–right from architecture to design, and pre-fabricated structure to fast-forward elevators.

The purchase and sale of immovable properties in India by a Non Resident Indian (NRI) or by a Person of Indian Origin (PIO) is really a very simple and easy affair with not much hassles and problems.

Chennai is known for its conservative mind-set, which reflects visibly on its residential property market trends, as well. For instance, home buyers in Chennai have historically been driven by location over and above most other considerations, and this had put definite limits on the demand and potential for community living in the city.

Fitch Ratings says in a new report that the Rating Outlook for the Indian real estate sector continues to be Negative for H212, due to persistent sluggish demand, high construction costs and liquidity pressures.

Money generated through illegal means is laundered through various means including real estate and election campaigns in India, a report of the US State Department has said.

The institutional projects in India are normally working in a PPP model because such projects have long payback periods and require large capital investment. Further, they are large in size and hence require number of approvals, making Government participation relevant to secure initial approvals, clearances and get the project going.

Jones Lang LaSalle’s REIS findings are in, and a closer look at the 1H12 data reveals relatively subdued activity during the period compared to 1H11. In 1H12, the top seven cities of India together recorded a 35% dip in absorption compared to 1H11. The contraction in demand caused developers to progress more slowly on their projects thereby aligning the supply with demand.

The RBI, on Tuesday, July 31, kept the repo rate or the rate at which banks borrow from RBI unchanged at 8% and also the reverse repo rate at which, the banks lend to RBI unchanged at 7%. However, it has lowered the statutory liquidity ratio (SLR) to 23% from 24% earlier. The realty sector, reeling under liquidity pressure and low demand due to high interest rate, has reacted sharply over this status quo.

According to the latest RICS India Commercial Property Survey, sentiment in the Indian real estate market has been adversely affected in the second quarter, as the economic picture in the country continues to remain bleak with the declining value of the rupee and growth forecasts being revised lower, along with a deteriorating global climate.