The need for better regulation in Indian real estate

The organized segment of Indian real estate is only about two decades old. It could be seen as understandable that true governance is too much to ask at this early point.

The organized segment of Indian real estate is only about two decades old. It could be seen as understandable that true governance is too much to ask at this early point.

A prominent group in Singapore plans to act as a facilitator to bring in China’s savings into the Indian economy and other South Asian countries.

Two marquee international brands — Giorgio Armani and Ferragamo — that have joint ventures with leading realty player DLF group’s subsidiary, DLF Brands, have been talking to other corporate groups and investors to scope out the potential of changing their Indian partner.

The Indian rental housing sector is seriously under-serviced by the organized real estate industry.

India is rapidly urbanizing, not only in form and features but, from within.

Urban Development Minister Kamal Nath admitted today that “the government has not responded to the tremendous growth in the real estate sector in the last one decade appropriately”.

The government is keen to clean realty deals and wants to crack down on money laundering. It wants a closer look at the real estate market, widely perceived to be the biggest sink of black money in India.

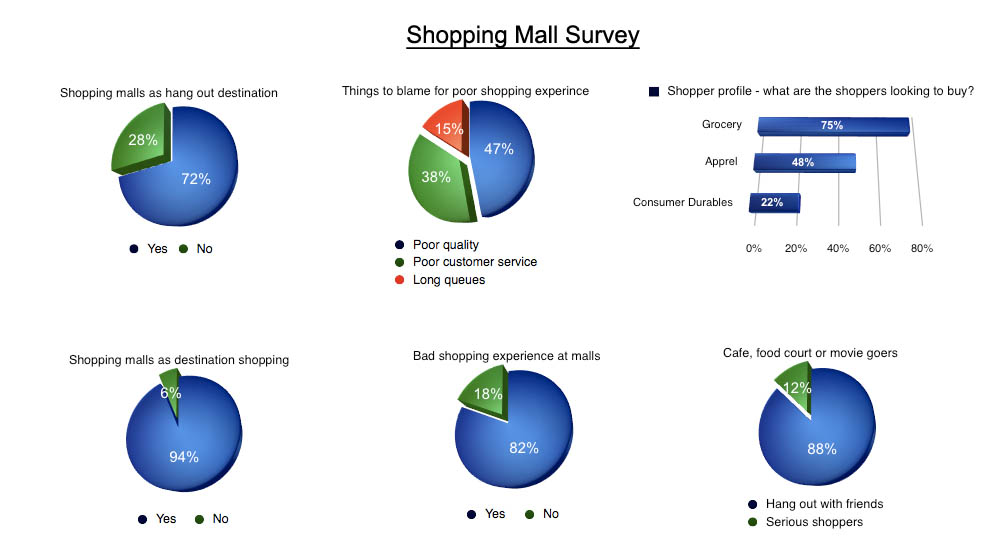

As many as seven out of 10 Indians with disposal income, a whopping 72 per cent, go to shopping malls at least twice a month but don’t buy the monthly food & grocery, apparels or consumer durables over there.

The concept of international, standardized luxury floor space must evolve further before India can absorb the demand. Developers must come up with more imaginative ideas of differentiating their luxury malls from the run-of-the-mill.

We are happy with the governments focus on affordable housing. Loan amount that qualifies under priority sector lending. Now, a home loan of Rs. 25 lakh would qualify as priority sector lending.