Emaar takes stock of Indian property

Emaar Properties PJSC, Dubai’s largest real-estate firm, has asked consultants and investment bankers to value its Indian joint venture Emaar MGF Land Ltd’s assets.

Emaar Properties PJSC, Dubai’s largest real-estate firm, has asked consultants and investment bankers to value its Indian joint venture Emaar MGF Land Ltd’s assets.

Real estate has emerged as the most preferred investment avenue for working professionals in non-metro centres vis-à-vis bullion and stock market.

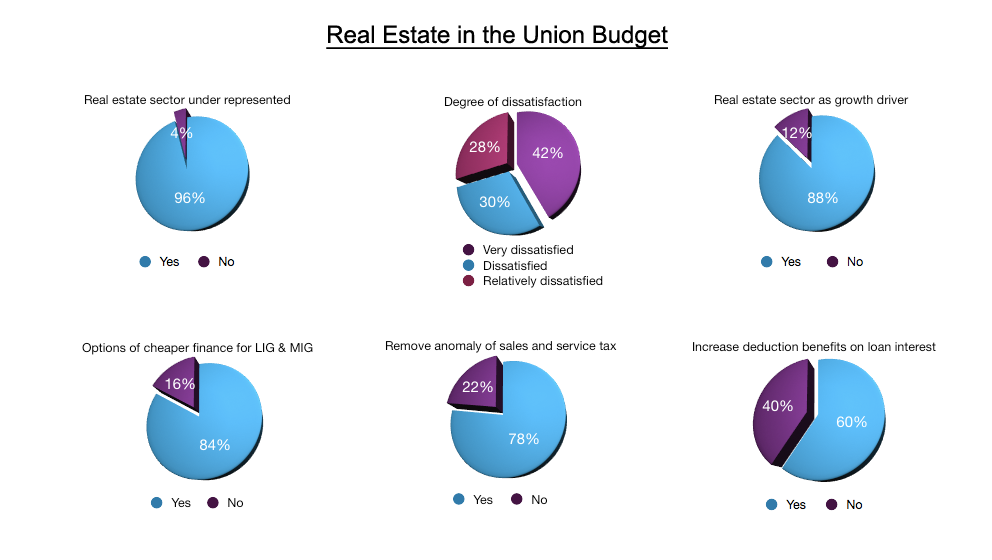

Real Estate may boast off to be the second largest economic activity and the largest employment provider in the economy, but when it comes to have a say in the policy making, they are found to be sulking.

Nearly all the real estate developers, a whopping 96 per cent, across the country are cribbing for the sectors’ continued under representation in the Union Budget over the years.

While the Indian realtors have often cribbed on the issue of under representation of the sector in respective budget, they have seldom admitted the fact that the real estate has been a divided house over their wants and needs. Navin M Raheja, MD, Raheja Developers suggests a way out and asserts that tax sops given to real estate will actually increase the government revenue.

Baring Private Equity Partners India (BPEP), along with some of its international investors, is likely to invest about $75 million, or approximately Rs 350 crore, in the Bangalore-based Century Real Estate. Baring’s individual commitment to the deal is around $53 million, while overseas investors who are backing the fund may bring in a little over $20 million in additional investment.

Gurgaon initially gained prominence as an outsourcing centre for major international companies that found it cheaper to locate their back-end operations in India due to the availability of high-quality but cost-effective employee resources. GE Capital initiated this trend and was the first multinational company to enter Gurgaon in 1997.

While there seems to be a crisis of credibility in the real estate sector on part of the investors, a survey by the Associated Chambers of Commerce and Industry of India (Assocham) says otherwise. It says the traditional investment options like gold, government bonds and bank fixed deposits are considered old school.