Better eco system needed to check delays

Track2Realty view on project delays The lack of regulations is…

Track2Realty view on project delays The lack of regulations is…

Gaurav Kapoor booked a flat in one of the newly launched projects of Delhi-NCR in early 2007. He was promised the flat would be ready for possession within three years with a grace period of six months. To play safe Gaurav even opted for a construction linked payment plan to the developer but six years have gone and he is yet to get his flat and every time he has approached the developer, various reasons for delay have been cited from macro economic conditions to funding woes and approval delays on part of the government agencies.

“How long can a sector survive which is borrowing at 48 per cent from private lenders to serve the interest of previous debt raised at much lower rate,” asks a banker. His concern is not without valid reasons. Developers experimented with all funding options but still many of them are now being forced to seek other sources of funding which not only comes at a significantly higher cost but also where the source of fund is unregulated.

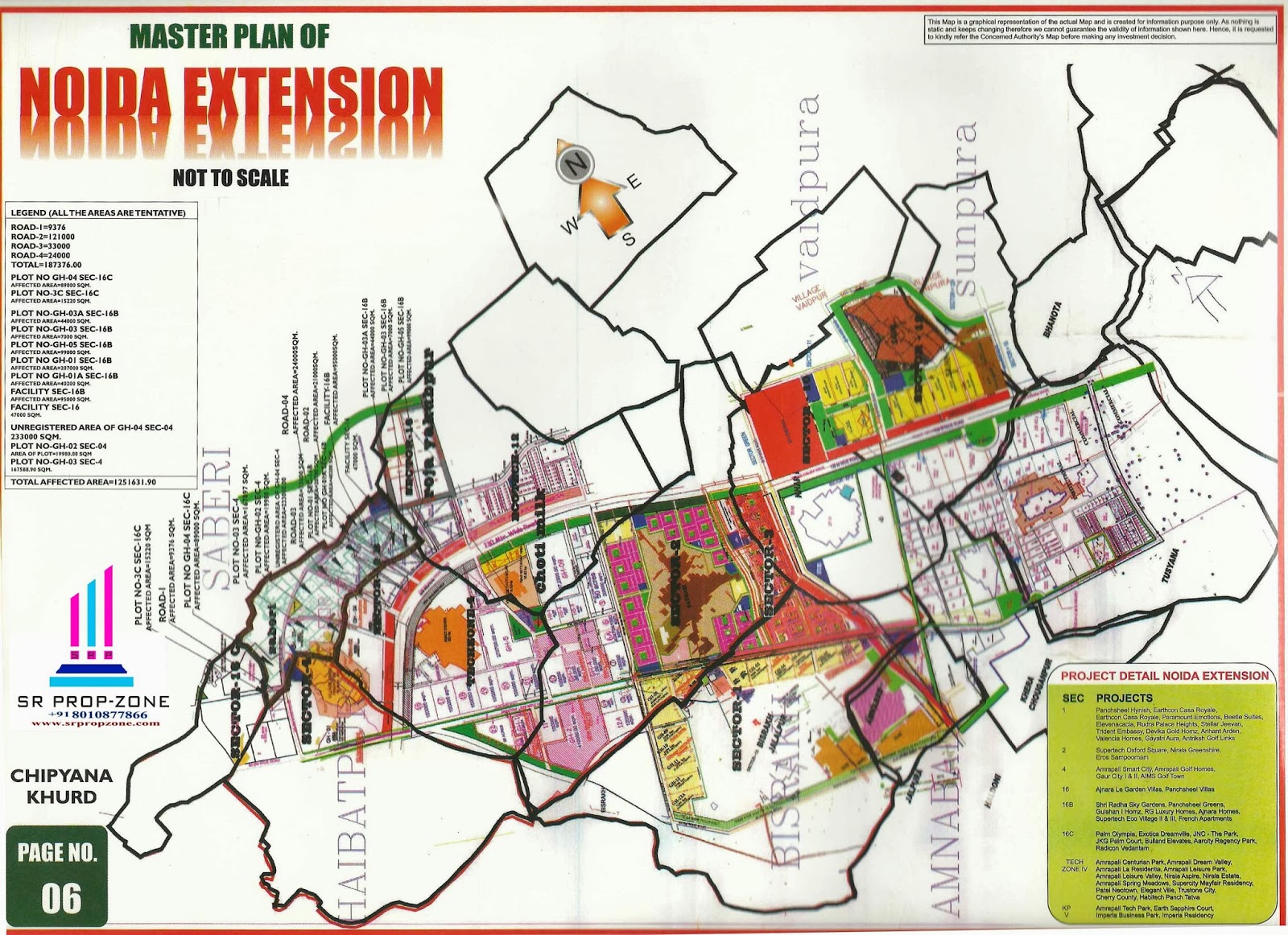

No other residential micro market of India has arguably weathered as many challenges and controversies as Noida Extension. Its inception as a separate zone, other than Noida & Greater Noida, did lend credence to conspiracy theories against the farmers that culminated into land acquisition litigation. Since then it has been a sordid saga of project delivery uncertainties and homebuyers endless wait; not to speak of the additional charges levied as against the compensation amount hiked to the farmers.

Track2Realty Investment Magnet Report 2015 tries to decode the alphabets of India’s housing market. The editorial team has not invented these alphabetic connotations and everyone in the sector is well aware of the alphabetic practices as well, yet we simplify it for the average investors and homebuyers who often forget the basics that make their fortunes vary. Familiarity with the given A to Z is often the difference between a skilled homebuyer and a novice.

Some key findings that indicate the aspiration quotient and standing of the Indian real estate:

88% Indians find real estate is still best asset class to invest

72% believe pre-launch or early stage of construction is best bargain

78% maintain upcoming locations give better returns than prime localities

84% homebuyers are sulking & repent their home buying decision

46% homebuyers have too serious issues with the developer to reconcile

All over the world, cities are facing the challenge of uncontrolled urbanisation. According to the United Nations, 54% of the population across the world today resides in urban areas, and that this figure will rise to 66% by 2050. An accompanying fact is that urbanization is happening too fast, and without adequate foresight and planning.

Eleven real estate developers have come together to promote the…

MCHI-CREDAI has entered into a strategic alliance with Housing.com on the occasion of the former’s property exhibition’s 25th edition. In a bid to enhance real estate ecosystem in India, the most-awaited expo of the season will witness 250+ top developers (exhibitors), first-ever affordable housing pavilion, and the first-time ever virtual exhibition which will continue for 21 days post the 4 days of on-ground event.

Tata Housing has announced India’s 1st ever “Social Sell”, on Facebook. Announcing the pre-launch of its project “Codename – Goa Paradise”, prospective buyers need to register themselves through Facebook to ensure they receive their unique invite Code. This unique invite code would ensure and allow customers to login on 26th Oct and book these limited homes on a first come first basis.