Chennai home buyers can complain by e-mail

The Confederation of Real Estate Developers’ Association of India (CREDAI) has put house buyers’ grievance redressal mechanism on the fast track by introducing an e-based redressal system.

The Confederation of Real Estate Developers’ Association of India (CREDAI) has put house buyers’ grievance redressal mechanism on the fast track by introducing an e-based redressal system.

After the Allahabad high court cleared land acquisition in 60-odd villages, barring a few where no real estate activity was on, hope has begun floating for thousands of middle-class buyers.

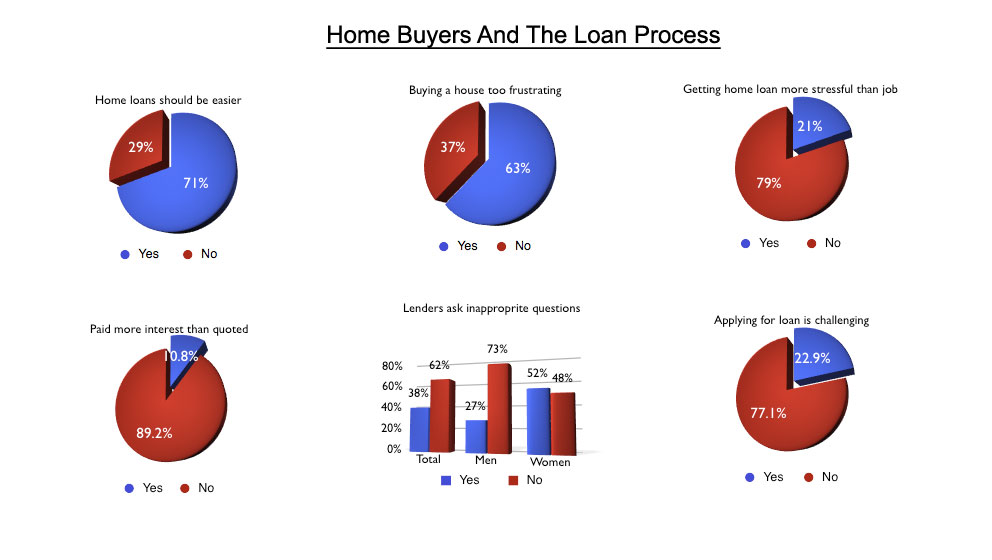

While buying a house two out of three Indians (70.6%) demand a simpler, more understandable home loan procedure.

Real estate developers have called for focussed support in the Budget for the first-time home buyer and measures to augment supply of housing for affordable and low income groups. Industry representatives have also called for a simplification of systems and tax reliefs as a step to bringing down costs and catalyse developments.

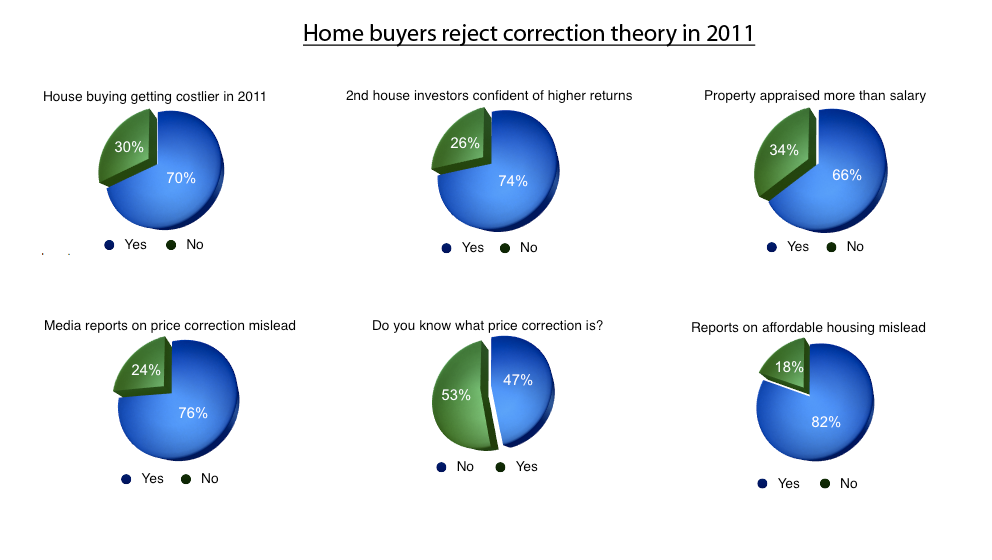

Don’t wait for the right time to buy a house expecting a price correction, say seven out of ten home buyers who are on house hunting. Contrary to the price correction reports, the property search of prospective buyers and sellers across the country have convinced them that cheaper house in 2011 are a fancy and wishful thinking. At least those who have done their home work on property search are pretty sure about it.

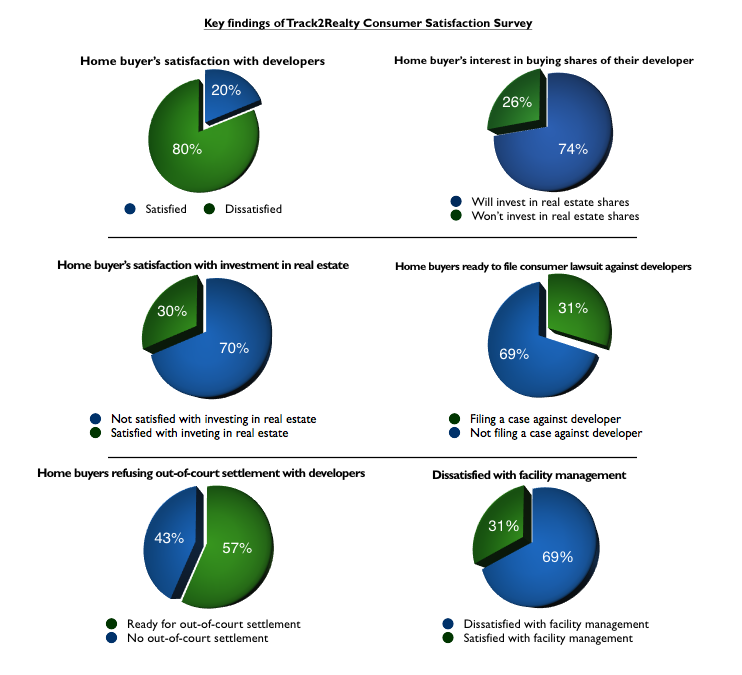

8 out of every ten home buyers in the Indian cities are sulking with the unfair trade practices of the real estate developers. Only 20 per cent of the buyers said they received a defect-free home and timely possession. The low customer satisfaction index was as much evident with developers offering affordable housing as with luxury housing.

If the removal of indexation benefits with Long Term Capital…

As the Finance Minister Ms Nirmala Sitharaman announced to lower the LTCG (Long Term Capital Gains) from 20% to 12.5%, the stock market took a hit. The analysts across the financial spectrum immediately swung into analysis that the LTCG hike would adversely affect the stock market in the short term but big pocket investors won’t be affected as much as presumed. A section of financial wizards who understand the nuances of personal finance across the asset classes had even bigger a worry – Real Estate. Prima facie what looked like the LTCG being lowered from 20% to now at 12.5%, has in fact hurt the property market the most. Reason: the indexation benefit under Section 48 that is presently available for property, gold, and other unlisted assets have been now proposed to be removed.

As RERA (Real Estate Regulatory Authority) is close to its 7 years of completion, the home buyers across the nation have more to complain than compliment with what was supposed to be a game changer legislation. The buyers rather question as to RERA has been enacted to serve whose purpose. Most of the home buyers across India’s top 10 cities point out that the ground realities have not changed for them. A vast majority of them feel it has opened another window of litigation and thus hurts than helps the buyers. Issues range from lack of transparency to accountability, and existing market realities to consumer interface.

The industry data of faster recovery and record home sales conceal more than it intends to reveal. The rosy outlook fails to address the fact that this is a K-shaped recovery where a handful of large developers with sound financials have grown at the cost of the large universe of the developers. More importantly, the sales registration data doesn’t differentiate between primary market sale and distress sale in the secondary market.