Bank loans to real estate drops sharply

Banking institutions have cut down on their lending to the real estate sector, according to a report put out on Wednesday by real estate consulting firm Knight Frank India.

Banking institutions have cut down on their lending to the real estate sector, according to a report put out on Wednesday by real estate consulting firm Knight Frank India.

More than 1,000 registered attendees from around the world will converge in Shanghai next week for the 2012 ICSC Retail Real Estate World Summit. More than 70 speakers around the globe from companies ranging from Apple and Walmart to India-based K Raheja Corp. will be discussing the latest trends transforming the international retail real estate industry.

DLF Chairman K P Singh has warned that the current policy paralysis has had an adverse impact on the country’s growth momentum denting business confidence, and could lead to its unique demographic dividend turning into a demographic nightmare.

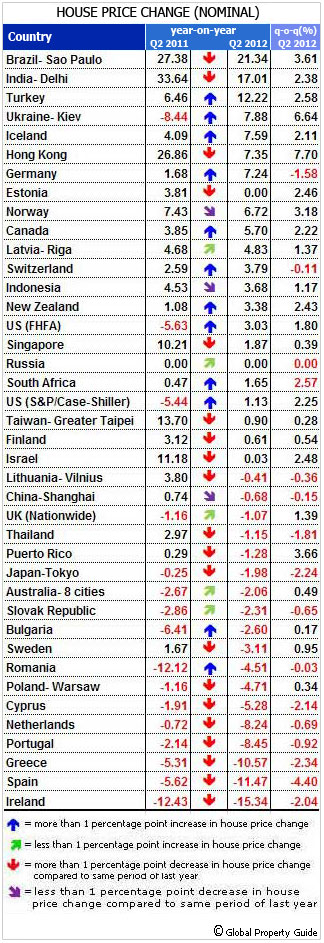

No end to the global housing market downturn is in sight, except probably in the US, according to a survey of global house price trends by the Global Property Guide Asia is weakening, and house price falls in the worst-hit European crisis countries are dramatically accelerating.

Interest from international real estate investors in Indian real estate has been limited in 2012. India has witnessed 6% q-o-q growth in direct commercial real estate in Q1 2012, as compared to China which has seen negative growth of -45%, however China performed better in Q2 2012 on the back of one mega deal. In Brazil, investment volumes seem to be reaching a more ‘normalised’, sustainable pace following the supercharged 2010-2011 period.

The Secretary, Banking, Ministry of Finance has agreed to look into the problems being faced by the real estate industry and work towards reducing the cost of funding through banks and financial institutions.

Foreign investor purchases in freehold projects in Dubai are still dominated by Indians who have retained the number one spot since foreign ownership regulations were applied, a new research has revealed.

Fitch Ratings says in a new report that the Rating Outlook for the Indian real estate sector continues to be Negative for H212, due to persistent sluggish demand, high construction costs and liquidity pressures.

The RBI, on Tuesday, July 31, kept the repo rate or the rate at which banks borrow from RBI unchanged at 8% and also the reverse repo rate at which, the banks lend to RBI unchanged at 7%. However, it has lowered the statutory liquidity ratio (SLR) to 23% from 24% earlier. The realty sector, reeling under liquidity pressure and low demand due to high interest rate, has reacted sharply over this status quo.

According to the latest RICS India Commercial Property Survey, sentiment in the Indian real estate market has been adversely affected in the second quarter, as the economic picture in the country continues to remain bleak with the declining value of the rupee and growth forecasts being revised lower, along with a deteriorating global climate.