Buyers allege project delayed, realtors say not denied

Delay in real estate projects is something that invites disapproval and criticism in the collective consciousness.

Delay in real estate projects is something that invites disapproval and criticism in the collective consciousness.

Though the Reserve Bank of India has laid out strict due diligence standards for banks for sanctioning loans to the real estate sector, industry experts believe lending to the sector will not decline.

Housing project is approved by the government agency; RERA; and banks & financial institutions! Shouldn’t this be enough to instil confidence of the home buyers that the housing project is safe to invest? How could otherwise a builder with poor execution capabilities or fiscal imbalance cross the three eyes of scrutiny and dodge the bullet at each and every level of checks & balances? Track2Realty questions as to who is the custodian of due diligence in the housing market?

The Securities Exchange Board of India (SEBI) has introduced amendments to the REIT Regulations 2014, which outlines provisions for the formation of Small and Medium Real Estate Investment Trusts (SM REITs). With this the built environment of the Indian real estate has gone euphoric with the underlying promise to witness windfall into fractional ownership. It is perceived to be more lucrative than the existing REITs since the SM REITs encompasses both commercial and residential properties under the guidelines. A Track2Realty report.

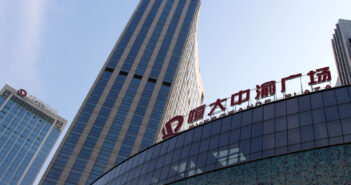

Within the built environment of the Indian real estate there is still denial about too many parallels between the Indian and the Chinese real estate. Many even believe that the Indian economy is not that real estate dependent as the Chinese economy. Even when admitting the crisis in Indian real estate, it is diplomatically wrapped in the developer’s justification of not learning any lessons on part of the Indian developers.

Various Government-driven policies including ease of doing business in India are attracting both Indian and global companies, squarely benefiting commercial real estate. Big-bang boosters like the start-up revolution and the Make in India and Smart Cities missions have created a very lucrative environment for businesses to work and expand in India.

As per ANAROCK data, the top 7 cities currently have a total stock of 5.6 lakh delayed housing units worth a whopping INR 4,51,750 crore. These units were launched either in 2013 or before that. Lakhs of buyers across top cities – particularly MMR and NCR – have been left in limbo, leading to inconceivable mental stress and financial pain.

This policy ‘trishul’ brought about a paradigm shift in the way Indian real estate does business and laid the groundwork for improved transparency and efficiency in the sector. However, while end-user and investor confidence were rekindled for real estate, it did not exactly set the industry on fire with renewed interest.

The ancient Chinese curse ‘may you live in interesting times’ certainly has a lot of pertinence to Indian real estate today. These are doubtlessly ‘interesting’ times for the sector, which has transformed significantly over the last decade. The pace of transformation has been accelerated further by the Central Government’s reformative steps aimed at ushering in ‘Acche Din’ to the realty sector.

The Indian real estate market has always been notorious for its lack of transparency, and the changes in recent times has been less than desirable. As India aspires to get clean money into the sector, the foreign funds too have high standards in terms of service quality and clarity.