Cushman & Wakefield sets up office in Ahmedabad

Cushman & Wakefield has opened its new office in Ahmedabad…

Cushman & Wakefield has opened its new office in Ahmedabad…

Beyond what is happening in the strategic board room meetings of realty companies, market is cautiously optimistic that with the inventories piling up, developers will sooner or later be forced to blink. A look at the recent developments in the sector does indicate that prices can come down, but it all depends on the builders holding power.

India today needs global products and large scale regions to be developed which has to have inherent quality of having a good financial ecosystem, legal ecosystem, administrative ecosystem and the ecology of real estate has to function under the regulatory environment. But the regulatory environment should not be restrictive and instead focused to give impetus to the industry.

Real Estate in India is touching great heights and you will find many Property Consultant and Brokers sitting to finalize a deal with the buyers. Once in a lifetime everyone wants to experience – buying a residential or a commercial property and it is a requisite to be extra cautious while buying a property in India.

Quality has suddenly become the buzzword in the realty sector to tide over the unprecedented crisis meet with the uncertain times ahead. Builders are now hiring quality surveyors, construction project manager, energy efficiency specialists and others who can get them quick buyers.

Till the ‘90s and even early years of the last decade, commercial real estate was being built as just another asset class to be leased out to entrepreneurs who would start or expand business as and when required. Most office buildings were largely built in the central business districts of various cities, functioning primarily as the central node where most of the commercial activity of the city took place.

The unprecedented restructuring of project portfolio, selling of land bank, exiting non-core business and the job cuts have yet not led the Indian real estate into the desired comfort zone. The realization to shed the flab has on the contrary left some of the developers to outsource the project execution and pay more.

We are all talking about reforms in the Indian real estate. However, while a structural reform is the need of the hour, it is equally important to understand that efforts to regulate the sector by almost all possible players in the ring are actually detrimental for the overall growth of the sector. This also raises the fundamental question as to reforms at what cost and for whose benefit.

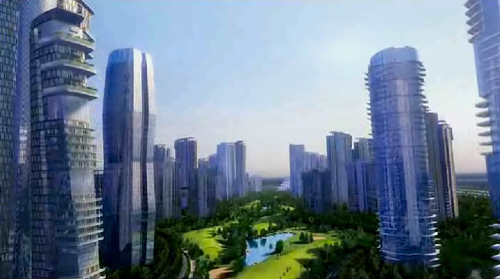

During the boom, many developers dreamed of transforming the urban landscape with millions of square feet of homes, offices and malls and set off on an aggressive expansion financed with debt that at 6 percent interest was cheap by Indian standards.

The operational inexperience of the developers’ is also being sewn up through strategic tie-ups with the majors in the hotel industry. An improving economic scenario and demand for more hotel rooms across categories is persuading international hotel chains to sign new management contracts with Indian developers and property owners, according to analysts. The industry will witness the announcement of a number of new hotels in the year ahead.