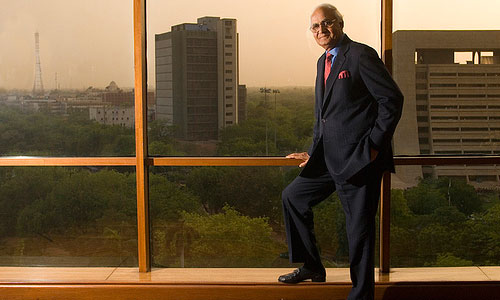

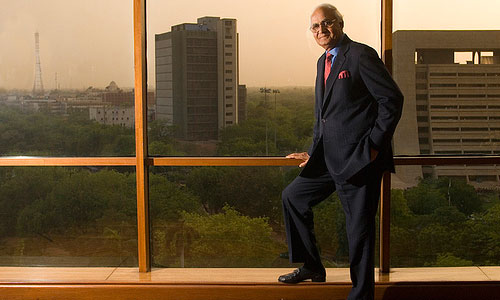

Don’t stunt real estate growth: DLF Chairman KP Singh to RBI

DLF’s Chairman K P Singh has said that RBI’s monetary policy should not stunt the growth of real estate sector and uninterrupted access to affordable finance is vital for this business.

DLF’s Chairman K P Singh has said that RBI’s monetary policy should not stunt the growth of real estate sector and uninterrupted access to affordable finance is vital for this business.

Runwal Group, has reportedly purchased Neosym Industry Ltd, a metal manufacturing company located on LBS Marg in Bhandup owned by Kolkata industrialist C K Birla’s family.

The real estate sector is ready to have its own regulator. Sector is actually craving for a regulator as we have come to understand that a single window will give us a way forward to growth and customer satisfaction. At this moment we are living in a regime of 40 NOC’s to a project and still no permission to function. It has no meaning and it does not give us the freedom to grow.

Pointing out that real estate development can revive the sagging economy, developers’ apex body CREDAI has called for launching a mission to make India Housing Surplus from the current status of a housing deficit nation by 2020.

In the past, Ahmedabad – the largest city of Gujarat – was largely thought of as a trading hub with localized market drivers. Today, we can confidently state that nothing could be more further from the truth. Jones Lang LaSalle India made a well-researched move when it launched operations in Ahmedabad in 2009. The decision to enter the city was based on its unmatched promise as a potential real estate investment destination, which factored in the city’s healthy local demand, as well as its outstanding industrial story.

Industry experts assert it is difficult to put a time frame on certain requirements like getting over a 100 Government permits from the time of starting construction to completion. Historically, hotel construction in India has been somewhat cumbersome owing to the multiple clearances/approvals required from Central and State Government agencies.

During the boom, many developers dreamed of transforming the urban landscape with millions of square feet of homes, offices and malls and set off on an aggressive expansion financed with debt that at 6 percent interest was cheap by Indian standards.

In the wake of the Competition Commission of India (CCI) imposing a hefty penalty of Rs. 630 crore on DLF, the anti-monopoly regulator has been flooded with a host of real estate related consumer complaints which may not be in the ambit of CCI. CCI should draw a line that bifurcates between what falls in its domain and what is in the consumer protection ambit. However, in the absence of scientific economic analysis of the relevant market, both in product category and geographic category, the two legs of the relevant market, the sector is keeping its fingers crossed as there has been a clear anomaly in defining the relevant market by the CCI.

The Competition Commission of India has found cement manufacturers in violation of the provisions of the Competition Act, 2002 which deals with anticompetitive agreements including Cartels. The order was passed pursuant to investigation carried out by the Director General upon information filed by Builders Association of India.

Sahara Infrastructure and Housing, of late being in the news for market regulator Securities and Exchange Board of India’s (SEBI) rap for mopping up Rs 17,400 crore through debentures and delayed project completion has now announced another 68 projects within FY 2012 – 13 across India. A statement issued by Sahara claims to introduce 10 lifestyle township projects, of which 9 will be self sufficient integrated townships under the brand name of ‘Sahara City Homes’ and 1 under the brand name of ‘Sahara Grace’.