South Mumbai property goes northwards in demand

When a property dealer suggested Kartik Shah to set up his office at Navi Mumbai, instead of South Mumbai market, it seemed to be a sound business sense.

When a property dealer suggested Kartik Shah to set up his office at Navi Mumbai, instead of South Mumbai market, it seemed to be a sound business sense.

Ascendas India Development Trust (AIDT), the India-focused real estate fund floated by Singapore-based office space developer, is looking to raise close to $350 million.

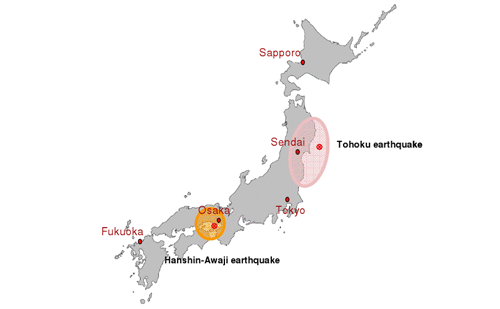

On 11 March, a major earthquake and tsunami hit Eastern Japan. According to official statistics, the number of deceased had surpassed 13,000 as at 14 April.

Urbanization rate is on the increase – and while there had been a few setbacks over the past few years, the Indian luxury retail market is firmly back now. The economy once again supports the rationale for spending on luxury goods, and it will continue to do so.

The Fitch Ratings 2011 outlook for the Indian real estate sector seems to contradict itself. While it says the realty market is stable in the year, it also warns of a negative bias. The negative forecast of Fitch Ratings is, however, based more on the sentiments than the emerging market reality.

Jones Lang LaSalle, in conjunction with Blake Dawson, has produced its first Asia Pacific Property Investment Guide. Asia Pacific has a wide range of real estate markets – each with distinctive rules for investors. The guide covers important issues that investors need to consider when investing in real estate around the region.

Stock market correction is generally perceived to be the time for fresh entry or buying more stocks. Right? It is not only seasonerd investors but even the immatures ones also try best to time the market. Timing the market is basically making an assessment as to when the market is at its lowest point and is poised for a turnaround. It is a different matter that market has always rewarded those who spend long time in the market rather than trying to time the market.

The real issue here is not desire to pay in cash but Triple Taxation in real estate purchase. Suppose a home buyer has INR 1 crore as earned money with him. Now it goes without saying that one must have paid 30% tax over this amount, if it is a bankable transaction. But for him Double and Triple Taxation in home purchase is 5% GST and 7% Stamp Duty. If there is a difference between Circle Rate and Fair Market Price, one would pay some amount, say INR 20 lakh in cash. Mind you! This is not Black Money but his Hard-Earned and Taxed Money but by paying INR 20 lakh as cash one is saving 5% GST and 7% Stamp Duty. So, a cash transaction of INR 20 lakhs saves him INR 2.40 lakhs. That is the whole game why everyone loves cash in the business of real estate.

Surrounding this is 14.9 acres of open space and five exclusive themed courtyards spread across 8 acres, including a 3-acre “Mother Earth” zone, a celebration of nature woven into the fabric of everyday living. Complementing the community’s verdant character is a 1.5-acre Spanish-styled clubhouse, exuding grandeur and elegance, which overlooks a podium and two 13,000 sq.ft. swimming pools. Casagrand Casamia offers over 160 world-class amenities, from immersive VR-enabled squash courts, sky cinema, and an open-air amphitheatre to picnic zones, themed gardens, kids’ play areas, and a scenic pond.

One question that I am asked at various forum is that whether one should buy a house on loan. Of course, this has reference to my public view across media spectrum that a home loan is more often than not liability and not leverage in India. I must admit here that seeking an answer to this question, most of the people asking this are already having an opinion on this. All that they need is a confirmation bias; something that they could justify to self and others with a statement of confirmation. Someone who understands the world of real estate and finance also said this. Right?