Realty at the bottom of the pyramid

While everybody, including the Finance Minister seems to be focussing on the affordable housing, the definition of the real estate at the bottom of the pyramid seems to be changing.

While everybody, including the Finance Minister seems to be focussing on the affordable housing, the definition of the real estate at the bottom of the pyramid seems to be changing.

The Finance Minister seems to be getting more appreciation than brickbats for renewing focus on the housing needs of Aam Aadmi. Even the real estate sector is divided and while the long awaited demands have not been fulfilled, a section of the realtors with affordable housing projects have appreciated the efforts.

Value and Affordable housing remains a segment where government should definitely continue to provide developers with tax free status which was available earlier. Rather than restricting it to unit sizes as in the past of 1,000 / 1,500 sft per housing unit, the government could instead have a maximum per unit value of say Rs. 15 lakhs for units near Tier I Cities, Rs. 10 lakhs for Tier II Cities.

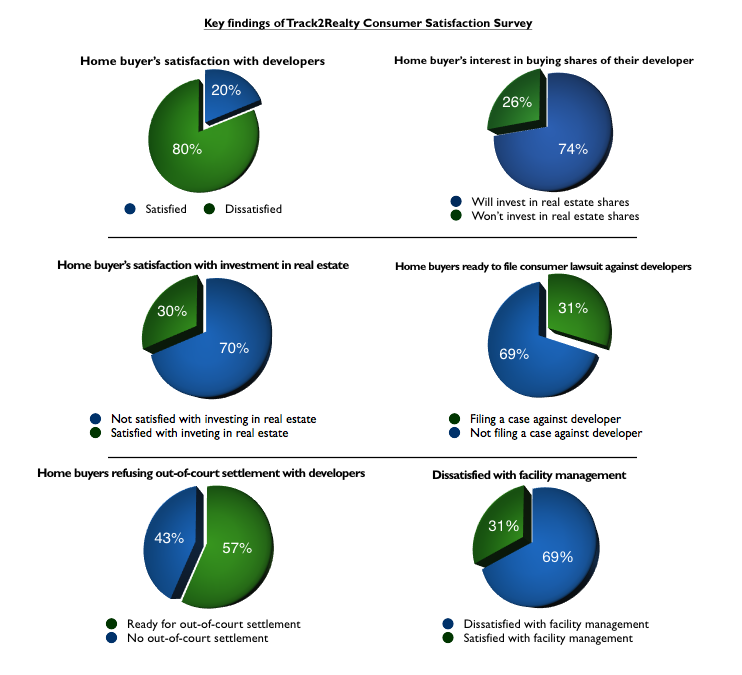

8 out of every ten home buyers in the Indian cities are sulking with the unfair trade practices of the real estate developers. Only 20 per cent of the buyers said they received a defect-free home and timely possession. The low customer satisfaction index was as much evident with developers offering affordable housing as with luxury housing.

This long-term growth in real estate is underpinned by six salient growth levers which includes, rapid urbanization, infrastructure development, digitalization, demographic shifts, sustainability and investment diversification; all of which will form the bedrock for a quantum leap in Indian real estate by 2047. These long-term growth ingredients will be pivotal in the expansion of Indian real estate – from under a trillion currently, to potentially a USD 10 trillion market by 2047, accounting for a 14-20% share in the country’s GDP.

PMAY (Pradhan Mantri Aawas Yojana) is once again in the news after the Union Budget 2023-24. But a project that should have been seen as a mission is in the news for some wrong reasons. It’s not just the fact that the Government of India has not clarified its achievements with Housing for All by 2022, but Track2Realty finds there are data discrepancies with the project as well.

Understanding the mindset of Indian real estate has never been easy. The built environment of the Indian real estate could argue and demolish the best of consumer-centric reforms. Remember the way industry body CREDAI had called RERA prior to its inception, and that too in front of the then Union Minister Kamal Nath, builder harassment and public amusement bill. But at the same time they celebrate the self-inflicted injury on many occasions. Track2Realty finds the overtones of the sector all the more contradictory with the Union Budget, before and after the budget.

As the Finance Minister Ms Nirmala Sitharaman announced to lower the LTCG (Long Term Capital Gains) from 20% to 12.5%, the stock market took a hit. The analysts across the financial spectrum immediately swung into analysis that the LTCG hike would adversely affect the stock market in the short term but big pocket investors won’t be affected as much as presumed. A section of financial wizards who understand the nuances of personal finance across the asset classes had even bigger a worry – Real Estate. Prima facie what looked like the LTCG being lowered from 20% to now at 12.5%, has in fact hurt the property market the most. Reason: the indexation benefit under Section 48 that is presently available for property, gold, and other unlisted assets have been now proposed to be removed.

53% of the developers saw a rise in buyer enquiries and engagement in 2023 compared to 2022. About half of the surveyed developers feel that residential demand would remain stable in 2024. Developers confident of an upward trajectory of housing prices in 2024. Nearly two-thirds of developers are willing to explore alternate segments like plotted developments, branded residences etc. within housing.

Between April and June 2024, residential supply witnessed the highest growth rate in the last 24 months, driven by the increasing availability of under-construction properties, shared the recently published PropIndex Report (April-June 2024) by Magicbricks, India’s leading real estate platform. According to the report, the supply of under-construction properties has increased by 11.7% QoQ, while prices have risen by 15.2% QoQ between April-June 2024. This surge has resulted in prices of under-construction properties surpassing those of ready-to-move properties in several cities such as Gurugram, Mumbai, Noida and Thane.