Realtors sulk under representation in budget

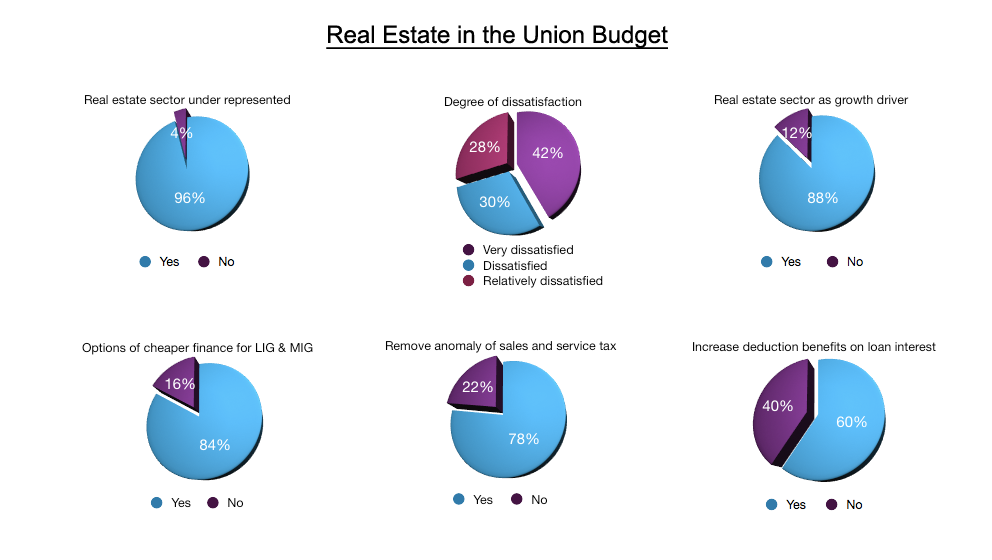

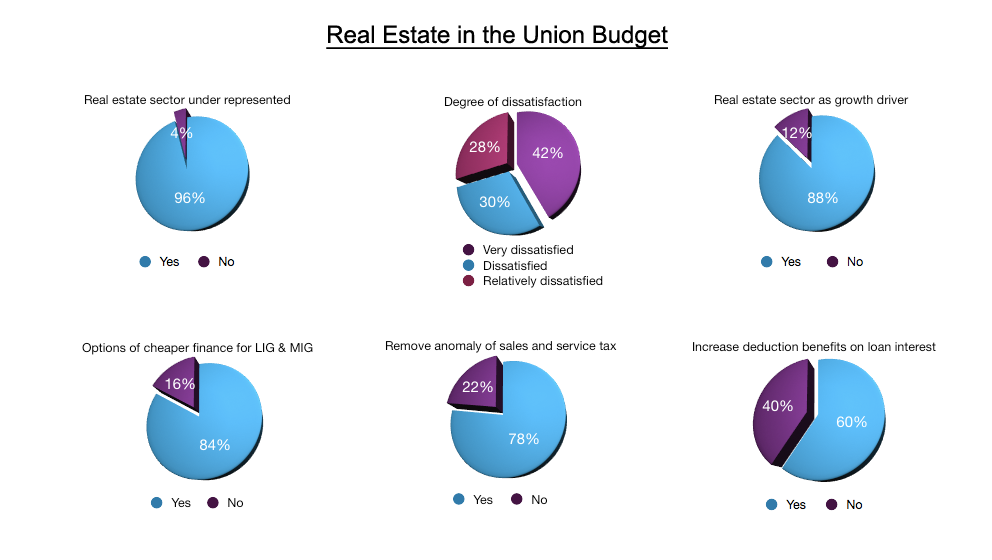

Nearly all the real estate developers, a whopping 96 per cent, across the country are cribbing for the sectors’ continued under representation in the Union Budget over the years.

Nearly all the real estate developers, a whopping 96 per cent, across the country are cribbing for the sectors’ continued under representation in the Union Budget over the years.

The Confederation of Real Estate Developers’ Association of India (CREDAI) has forecasted Kochi to emerge as the next realty hot spot in the wake of the commissioning of the International Container Transshipment Terminal (ICTT ) at Vallarpadam. CREDAI believes the prices of land and buildings are all set to skyrocket as it will generate more direct and indirect employment opportunities.

Urbanization rate is on the increase – and while there had been a few setbacks over the past few years, the Indian luxury retail market is firmly back now. The economy once again supports the rationale for spending on luxury goods, and it will continue to do so.

Abu Dhabi is hosting a new India property show that will bring over 100 projects from across India for the Capital-based Non-Resident Indians (NRIs), according to its organiser Future Exhibitions and Promotions (FEP). The inaugural ‘India Property 2011’ is scheduled to be held from today, February 11-12, 2011 in Abu Dhabi that will showcase affordable and hi-end luxury properties with competitive prices in the market starting from Rs1 million to Rs10 million.

Vascon Engineers Ltd, a Real Estate and EPC company, on a consolidated basis recorded a revenue of Rs. 215.82 crore for Q3FY11 as against Rs.158.60 crore in the corresponding quarter last year; marking a growth of 36.08%.

While the realty sector is cribbing for under representation in budget for the last few years, Atul Modak, Head of Mumbai-based Kohinoor City goes a step further to say realty sector not only gets under represented but also it is treated with a bias. He asserts that instead of seeing it as one of the sector responsible for growth of the economy, it is looked with a bias and taxed accordingly. In an interview with Ravi Sinha, he shares his budget wish list and concerns for the sector.

DLF Limited, India’s largest real estate company, recorded consolidated revenues of Rs 2,594 crore for the quarter ended December 31, 2010, an increase of 21% from Rs 2,151 crore in the Q3FY10. EBIDTA stood at Rs 1,292 crore, an increase of 33% as compared to Rs 969 crore in the corresponding period last year. Net profit was at Rs 466 crore, as compared to Rs 468 crore in Q3FY0. The non-annualised EPS for the quarter was Rs 2.74

Mumbai witnessed the highest absorption in the year in 4Q10 which was recorded at 1,328,582 sq ft (123,429 sqm) indicating robust demand. Demand for Grade A office space was broad-based and not restricted to the banking, financial services and insurance (BFSI) sectors, which typically dominate Mumbai’s tenant landscape. Domestic and multinational occupiers from the consulting, aviation, IT/ITES and other industries were active in acquiring front-office and back-office space in 4Q10.

The period ending 4Q10 witnessed low to moderate activity levels in the CBD and SBD of Delhi NCR. The CBD, with its low vacancy levels, continued to cater to small office queries, while the SBD with significantly more office stock, catered to the larger corporate office space demand.

As world business and political leaders today convene at the World Economic Forum Annual Meeting 2011 in Davos, Switzerland, Jones Lang LaSalle Chief Executive Officer Colin Dyer is speaking on four commercial real estate trends that are emerging as dominant forces supporting the global economic recovery in 2011.