Realtors sulk under representation in budget

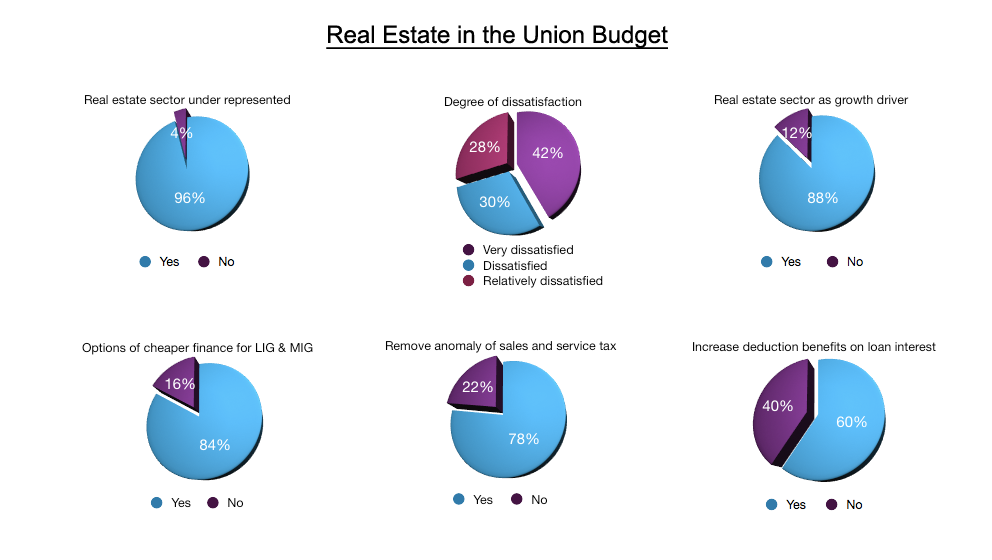

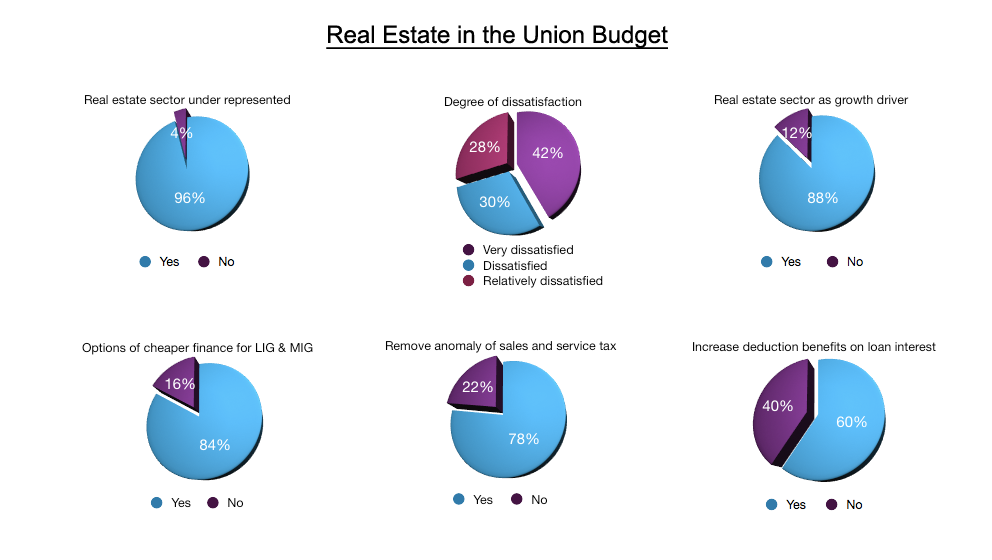

Nearly all the real estate developers, a whopping 96 per cent, across the country are cribbing for the sectors’ continued under representation in the Union Budget over the years.

Nearly all the real estate developers, a whopping 96 per cent, across the country are cribbing for the sectors’ continued under representation in the Union Budget over the years.

The Confederation of Real Estate Developers’ Association of India (CREDAI) has forecasted Kochi to emerge as the next realty hot spot in the wake of the commissioning of the International Container Transshipment Terminal (ICTT ) at Vallarpadam. CREDAI believes the prices of land and buildings are all set to skyrocket as it will generate more direct and indirect employment opportunities.

As real estate prices shoot up and interest rates, the outlook for the sector does not look too bright. In its year-end report, Knight Frank has stated that new home sales in India have fallen by 25 per cent due to soaring prices. With the Reserve Bank of India tightening lending norms to developers and raising interest rates, the property market is likely to plumb new lows in 2011 as buyers disappear.

If you are living as a tenant in Mumbai and seeking to buy a house this year, there seem to be quite a few confusions going around. While some of the reports and projected forecasts may give you a ray of hope, it would rather mislead you and your wait for a cheaper home may actually cost you to pay more in future.

We are looking at a potential situation in Mumbai’s office…

Real estate developers have called for focussed support in the Budget for the first-time home buyer and measures to augment supply of housing for affordable and low income groups. Industry representatives have also called for a simplification of systems and tax reliefs as a step to bringing down costs and catalyse developments.

The RICS, an international, self regulatory professional body relating to real estate, has called for a mechanism for consumer protection and fair practices in real estate transactions. This will also help increase domestic and foreign investments in this sector.

India is today facing a unique challenge of dealing with high inflation, while continuing on its high growth trajectory. Boosting of supply in all industries, including through incentivizing of infrastructure development, streamlining of regulatory process to reduce time and costs for business and tax incentives for low cost housing are all important areas which will help reduce inflation and also enable growth rates to be maintained.

Value and Affordable housing remains a segment where government should definitely continue to provide developers with tax free status which was available earlier. Rather than restricting it to unit sizes as in the past of 1,000 / 1,500 sft per housing unit, the government could instead have a maximum per unit value of say Rs. 15 lakhs for units near Tier I Cities, Rs. 10 lakhs for Tier II Cities.

Chicago-based Vestian Global Workplace Services, an integrated real estate services provider has announced to invest Rs 1,500 crore in India and China over the next 18 months. The company, which raised the fund from global investors, said about 70 per cent of the proposed investment was earmarked for the Indian market.