Asia Pacific investment demand to remain strong but activity set to moderate

Shortage of investible stock but opportunities in structural investment themes. …

Shortage of investible stock but opportunities in structural investment themes. …

When the going was good the developers did not bother much about the quality of talent; nor did they ever took a conscious call to introspect from the inside of the company and work their way out to create a competitive professional culture.

To say that the year 2015 has not been very excisiting for the real estate market across the Mumbai Metropolitan Region (MMR) would be stating the obvious. The slowdown in the macro-economy, wait & watch by the homebuyers in the property market, relatively higher cost of borrowing till late and fate of reforms oriented policies hanging in uncertainty all collectively dampenend the property market in India’s financial capital. Will the year 2016 be any different?

Some key findings that indicate the aspiration quotient and standing of the Indian real estate:

88% Indians find real estate is still best asset class to invest

72% believe pre-launch or early stage of construction is best bargain

78% maintain upcoming locations give better returns than prime localities

84% homebuyers are sulking & repent their home buying decision

46% homebuyers have too serious issues with the developer to reconcile

CBRE’s Retail Hotspots in Asia Pacific 2014reports on international retailer activity occurring in the APAC region. Established as well as emerging retail markets in the region saw 464 new retail entrants in 2014—23% more than in 2013.

Track2Realty Exclusive: Affordable housing has always been a wishful thought in Mumbai real estate and the call for the same has been reignited post the Government of India calling for a vision document to ensure houses for all by 2022. However, Mumbai is not like the rest of the country and the sky high land prices due to unavailability of developable and licensable land calls for a rethink over what precisely is feasible to create affordable housing stock in the city.

Track2Realty: A few years back, Hyderabad was offering the likes of Bangalore stiff competition for attracting office space investments. Today, the formation of a new state, a new government and a stabilized political environment are yet to instill the confidence that is needed to revive Hyderabad’s real estate fortunes.

Track2Realty: Pune’s rapid growth as a city is constantly pushing the envelope for real estate development. Suburbs that were considered ‘upcoming’ less than two years ago are now established destinations, with increased property price appreciation creating a challenge for budget home seekers.

Track2Realty: According to recent CBRE report—How Global is the Business of Retail?—new trends identified in the global retail market saw retailers focusing on larger markets in 2013, with 83% of the survey cities witnessing at least one new entrant in the year (compared to 81% in 2012), while the top target markets saw a 28% rise in new entrants.

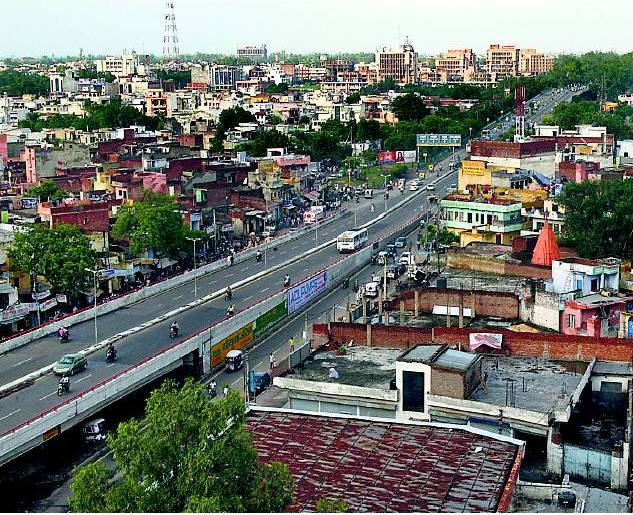

Track2Realty Exclusive: Real estate development along highways and expressways is an established reality of India’s urban growth, yet a few have been trend setters. These are the territories which have been investment magnet much before being fully developed. National Highway 24, popularly known as NH 24 that connects the national capital Delhi to Uttar Pradesh capital Lucknow running 438 kilo meter in length is one such highway which is being seen as the new growth corridor of north India in general and Delhi-NCR in particular.