IT notice to MMRDA, CIDCO

The Income Tax department has sent notices to real estate companies, MMRDA, CIDCO stating that all land lease sales or transfers attract a 10% tax, sources said.

The Income Tax department has sent notices to real estate companies, MMRDA, CIDCO stating that all land lease sales or transfers attract a 10% tax, sources said.

India’s urban housing today could at best be described as a soda bottle syndrome where the constant rural push to the select few urban centers could explode at any given point of time. It is not that the policy makers are unaware with the growing population and its dependence over the metro cities. As a matter of fact, when the country’s first planned city, Chandigarh, came into existence as a horizontal city that could cater as the capital of both the Punjab and Haryana State, it seemed to be independent India’s first tryst with organized urban planning in general and its housing solution in particular.

Mumbai real estate, often criticized for getting saturated, has been rather blessed with a number of hidden jewels. The city is sitting over some of the under-valued and lesser-known micro markets that are set to transform into property hotspots pretty soon. The cynics who thought that the peninsular city is left with no scope of horizontal growth have probably not visited any of these places.

Environmentalists have raised serious concerns over the devastating consequences of climate change. Calling it irresponsible, they question how could a parking lot service area for metro trains being allowed to destroy a critical green lung.

Affordable housing and Mumbai often sound to be quite contradictory. The peninsular city with limited land parcels and load on the infrastructure often makes an urban planner fumble for offering any sustainable solution. Critics hence dismiss the very idea of affordable housing in the city. In Mumbai the development and growth of affordable housing has also been facing significant challenges owing to a gamut of fiscal, regulatory and urban issues.

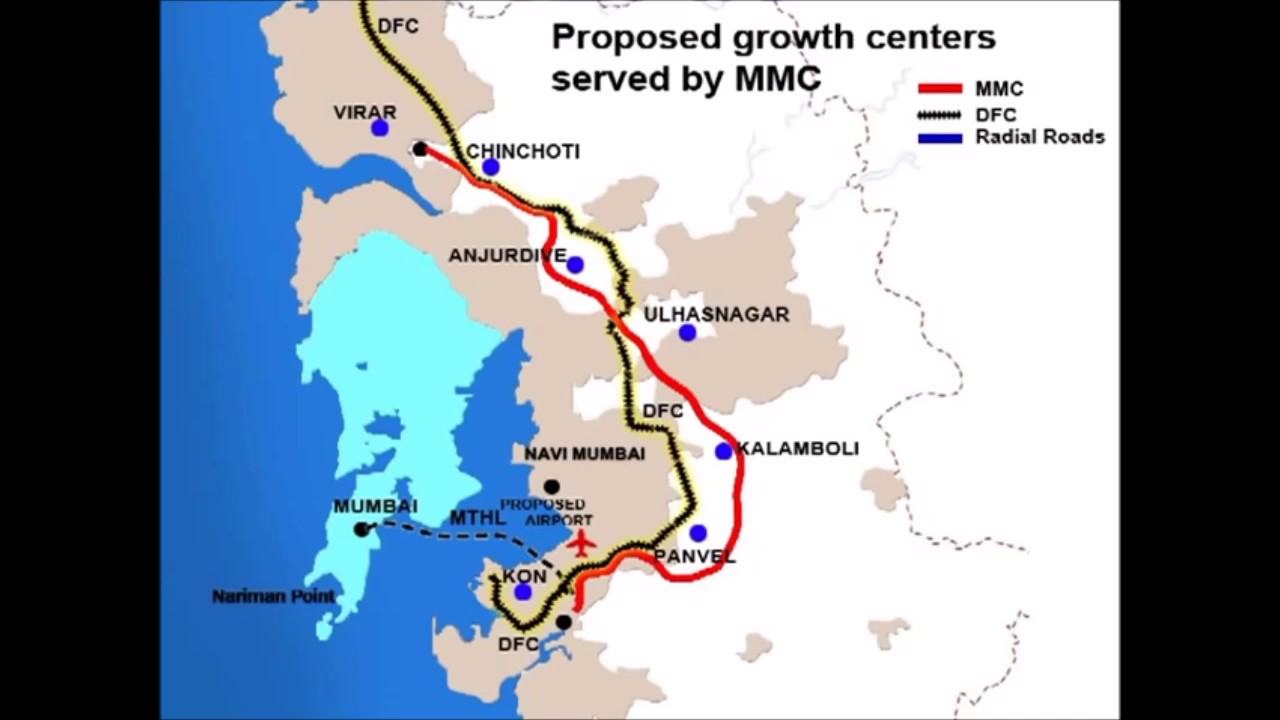

This 126 km long Virar – Alibaug Multi Modal Corridor will connect NH-8, Bhiwandi bypass, NH-3, NH-4 and NH-4B, Mumbai-Pune Expressway, NH-17, etc. Out of this 126 km corridor, 79 km long Virar (Navghar) to Chirner (JNPT) corridor has been declared financially feasible and has been approved by the Mumbai Metropolitan Regional Development Authority (MMRDA) in March, 2012.

Mumbai, as a matter of fact, demands rental housing to be promoted as the feasibility of such an option provides a broad choice of homes to both the investors as well as the expat professionals. The recent economic turmoil also underscored the many advantages of renting and raised the barriers to home ownership, sparking a surge in demand that has buoyed rental markets across the MMR.

Mumbai has been the undisputed financial capital of India. The emergence of other business destinations, like Bangalore, Gurgaon or Pune could not take the sheen out of the city, even in the wake of infrastructure deficit and other urban problems plaguing the peninsular city. Now the Mumbai city is poised to elevate itself to the next level of business destination. The MMRDA (Mumbai Metropolitan Regional Development Authority) plans to make Mumbai a major global financial hub.

It is the roll out of the policies by the respective urban bodies that have been behind the BKC emerging as a case study of urbanisation with booming economy while Noida ending up as a ghost city sitting over piles of unsold housing stock. Both the markets nevertheless had the tremendous potential in its early stage of inception.

Bottom Line: Large-scale affordable housing in cities is the greatest…