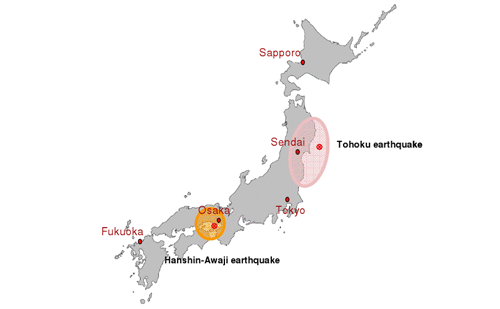

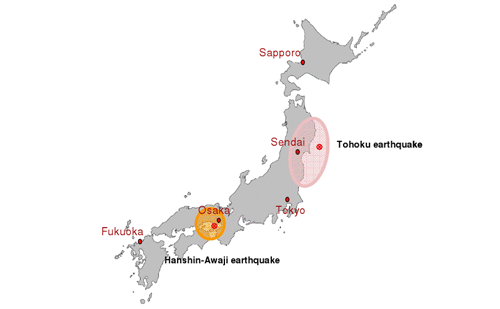

Impact of Tohoku earthquake over Tokyo office market

On 11 March, a major earthquake and tsunami hit Eastern Japan. According to official statistics, the number of deceased had surpassed 13,000 as at 14 April.

On 11 March, a major earthquake and tsunami hit Eastern Japan. According to official statistics, the number of deceased had surpassed 13,000 as at 14 April.

The Income-Tax department is planning to look into all suspected real estate deals to check involvement of black money component and tax evasion.

The Enforcement Directorate (ED) has unearthed 15 foreign bank accounts with direct links to realtor Hasan Ali Khan and his accomplice, Kolkata based businessman Kashinath Tapuriah.

With the Central Bureau of Investigation (CBI) charging Unitech Managing Director Sanjay Chandra as a key accused in the 2G spectrum scam and his brother Ajay Chandra appearing as a CBI testimony, it is generally believed that the two Chandra brothers are falling apart.

Capital markets regulator Securities and Exchange Board of India (SEBI) on Friday issued a public notice alerting investors about a ban on money mobilization by two Sahara group firms.

Germany-based home and kitchen modular furniture maker Hacker Kuchen GmbH is all set to enter into a MoU with DB Reality for supplying 900 kitchen modulars for various projects the real estate major is taking up in Mumbai.

As part of its social obligations, CREDAI (Confederation of Real Estate Developers’ Association of India) is planning to train unskilled labourers from 10 select cities in the country, with the assistance of National Skilled Development Corporation (NSDC).

Real estate developers across Gujarat have withdrawn stir as the government decided to give a 50% relief on increased jantri rates.

After making a mark in almost all areas it has touched so far, diversified conglomerate Jaypee Group has now set its eyes on the dairy sector, where the growing demand-supply gap is only set to widen further.

Sahara Housing Investment Corp. Ltd and Sahara India Real Estate Corp. Ltd, two firms that are part of the diversified Sahara India Pariwar group, continue to raise money from the public, defying a ban on such activity by capital market regulator Securities and Exchange Board of India (SEBI).