Is price correction inevitable in Mumbai?

Mumbai real estate is debating over a possible price correction as sale registrations for September recorded a 29-month low at 4,137, down 22 per cent year-on-year.

Mumbai real estate is debating over a possible price correction as sale registrations for September recorded a 29-month low at 4,137, down 22 per cent year-on-year.

The real estate market may be in a slump with developers innovating ways and means to increase sell, but the festive season seems to be bringing in good cheer for the country’s tallest tower — Lodha World One.

Continuous rise in interest rates by the banks is dampening the effort of the real estate companies to reduce debt by selling non-core assets.

Though the Reserve Bank of India has laid out strict due diligence standards for banks for sanctioning loans to the real estate sector, industry experts believe lending to the sector will not decline.

Union minister for urban development Kamal Nath on Thursday said the number of approvals a developer has to get will have to be cut down for faster and more efficient property development in the country.

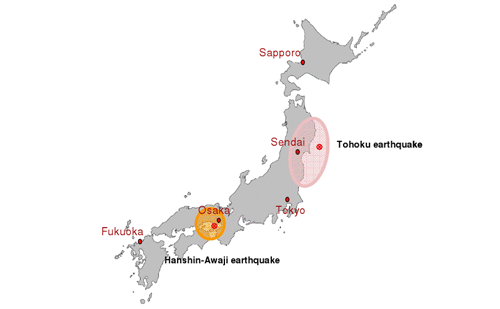

On 11 March, a major earthquake and tsunami hit Eastern Japan. According to official statistics, the number of deceased had surpassed 13,000 as at 14 April.

While the real estate market in India is far from satisfactory, a section of real estate developers are exploring opportunities in neighboring nations including Sri Lanka and Bangladesh as the governments, seeking to boost economic growth, are providing incentives to develop infrastructure.

CB Richard Ellis, the US-listed property services firm, has emerged as favourite to acquire the majority of ING’s real estate group in deal worth one billion euro (USD 1.35 billion) to create the world’s largest property funds business, says a media report.

After one and a half years of gradual consolidation, real estate in India has fathomed its own comfortable ground, and is poised at the right threshold to take a giant leap in years to come, according to the forecast of the Jones Lang LaSalle, the global real estate services firm.

With the return of confidence in the sector, Indian real estate players are now once again looking at private equity funding. That said, the industry still depends heavily on bank debt, NBFC funding and end-user advances. This is because bank debt is a cheaper option, and also because it offers flexible tenures.