The need for better regulation in Indian real estate

The organized segment of Indian real estate is only about two decades old. It could be seen as understandable that true governance is too much to ask at this early point.

The organized segment of Indian real estate is only about two decades old. It could be seen as understandable that true governance is too much to ask at this early point.

Villas are a unique product because unlike in apartments, the buyer gets to own the piece land on which the villa is built.

Over 60% of Indian software exports are to the US, and nearly 20% are to Europe. Since both these geographies are affected, there will eventually be an impact on Indian IT companies.

The CII Real Estate Conclave 2011, themed ‘Indian Real Estate Charting a Global Course’, organized in association with Jones Lang LaSalle on June 24, 2011 was a huge success.

India is rapidly urbanizing, not only in form and features but, from within.

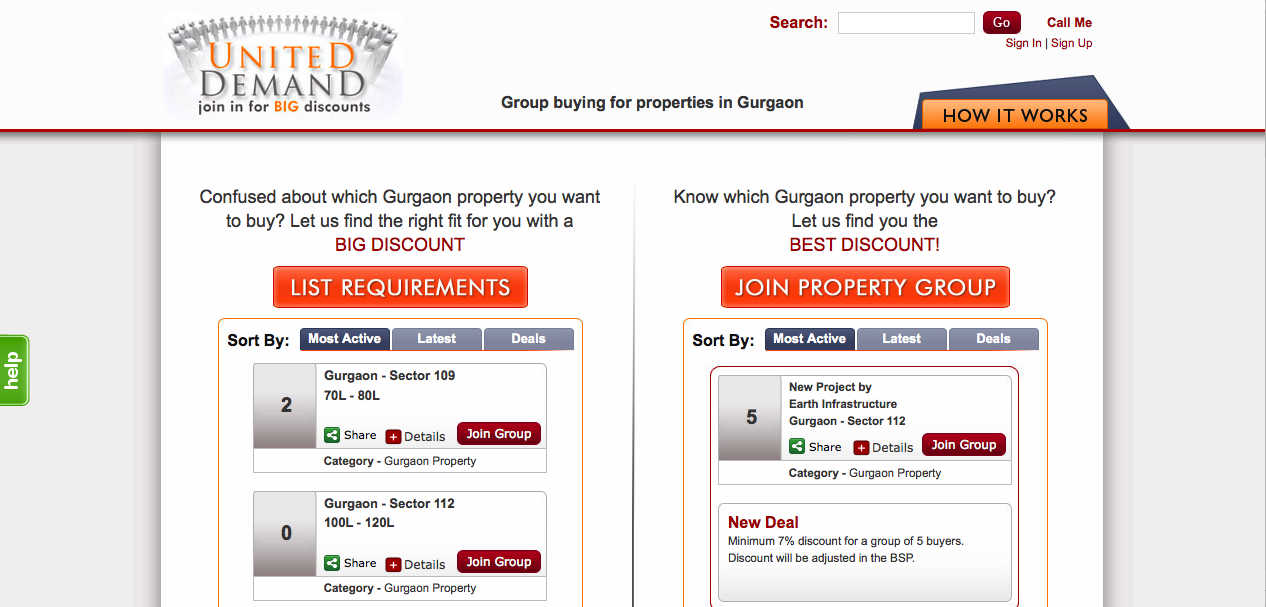

College student Karan Kanodia believes he has struck gold in the real estate market with his recently launched United Demand, an Internet-based business that brokers housing purchases between home buyers and developers in Gurgaon, India.

Through a hailstorm of bouquets, brickbats, controversies and triumphs, the Indian real estate sector has always been one of the mainstays of the country’s economy. At some level, every Indian is connected with it; in some way or the other, it affects every citizen of this country.

The housing and real estate sector in India witnessed foreign direct investment (FDI) of $2.8 billion in the fiscal year (April-March) 2009-10, according to Indian Department of Industrial Policy and Promotion. The statistics made available to the media at the India Home property exhibition, which concluded in Dubai on Sunday, revealed that total NRI FDI inflows through the period April-December 2009-10 stood at $320.05 million.

Demand for mid-segment residential units in Mumbai is far greater than available and future supply, therefore growth is expected in 2011. In the industrial sector, cities such as Ahmedabad, Vadodara and other port cities in Gujarat are seeing the highest growth.

The organized segment of Indian real estate is only about two decades old. It could be seen as understandable that true governance is too much to ask at this early point. However, we have reached a decisive point in 2010, which was indisputably one of scams.