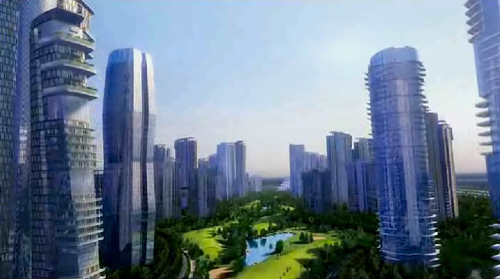

Developing new residential destinations in Mumbai

According to the 2010 census, Mumbai now houses around 14 million people, which makes it India’s most populous city and the world’s second-most populous city.

According to the 2010 census, Mumbai now houses around 14 million people, which makes it India’s most populous city and the world’s second-most populous city.

Hotel Leelaventure will invest Rs.100 crore to upgrade its property in Goa in 2011 and is looking to expand presence in the country by opening new company-owned properties and taking up management contracts.

Australia’s Platinum Investment Management has raised its stake in India’s second largest real estate firm Unitech to 5.16%.

The demand for commercial property in the country is expected to remain robust in the first half of 2011, boosted by strong manufacturing activities, says a survey by RICS India Commercial Property Survey.

Ashiana Housing strengthening its Facility Management arm, has launched resale and rental services for Ashianaites.

The Confederation of Indian Industry (CII) has said there is a need to improve the infrastructure and increase in flow of capital in the housing segment, given the increase in the land prices.

Indian real estate majors, DLF and Unitech, are set to miss their FY11 sales target, despite prices reaching the highs of 2007. Mid cap names like HDIL, Ackruti City and Sobha Developers are however on track to meet their targets.

Kotak Realty Fund, the property investment arm of India’s Kotak Mahindra Bank, plans to raise as much as USD 500 million by the second quarter of this year, in a bet on the long term case for property in Asia’s third-largest economy, a top official said.

Chennai-based real estate developer True Value Homes is planning to invest Rs.800 crore over the next three years to develop around 12 projects, majority of which will be in the residential segment.

Mumbai-based RCSPL, which owns group buying portal for real estate GrOffr.com, has acquired Mobstreet.in, a company which was officially shut down in December 2010 due to lack of funds.