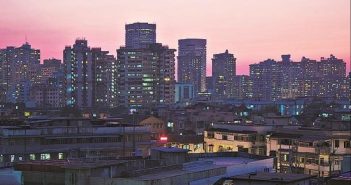

Is real estate realistic with resolution to make 2020 best year ever?

2020 hardly promises to be the #BestYearEver for the Indian real estate, simply because the sector has historically been arrogant to read the writing on the wall. They continue to live with their fancy illusion that this is just another cyclic slowdown. The raw statistics of ever increasing migration to the cities and the housing demand make them predict for self-belief that sooner than later the market will yet again turn out to be sellers’ market.