Indian developers to showcase projects in Doha property show

A two-day exhibition featuring 45 property developers from major cities of India is being held at Regency Halls on Friday and Saturday.

A two-day exhibition featuring 45 property developers from major cities of India is being held at Regency Halls on Friday and Saturday.

Indian real estate is expected to face “large-scale distress” amid rising borrowing costs and shrinking access to credit that may force developers into fire sales for assets, according to Knight Frank.

As part of its social obligations, CREDAI (Confederation of Real Estate Developers’ Association of India) is planning to train unskilled labourers from 10 select cities in the country, with the assistance of National Skilled Development Corporation (NSDC).

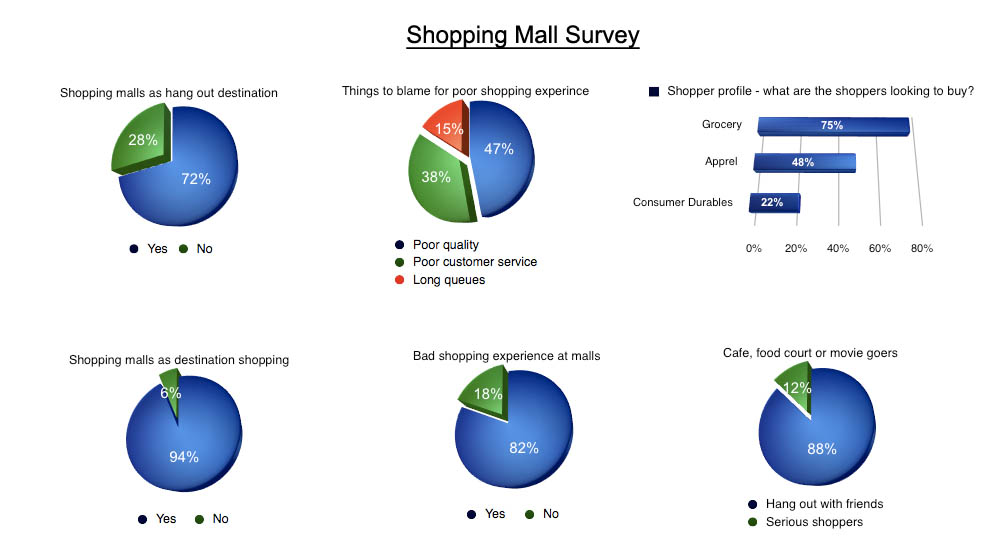

As many as seven out of 10 Indians with disposal income, a whopping 72 per cent, go to shopping malls at least twice a month but don’t buy the monthly food & grocery, apparels or consumer durables over there.

Emaar Properties PJSC, Dubai’s largest real-estate firm, has asked consultants and investment bankers to value its Indian joint venture Emaar MGF Land Ltd’s assets.

Indians are emerging as among the most active buyers of property in Britain, according to a report in local British media.

Four years after Singapore-based Ascott Ltd, a serviced residence operator, entered India, it has decided to part ways with its local partner in a bid to speed up expansion plans and have more control over its proposed projects.

The vision of owning a house is slowly getting clearer for buyers as residential real estate prices are beginning to see the promised correction on the back of hardening interest rates and poor transaction volumes.

The Finance Minister seems to be getting more appreciation than brickbats for renewing focus on the housing needs of Aam Aadmi. Even the real estate sector is divided and while the long awaited demands have not been fulfilled, a section of the realtors with affordable housing projects have appreciated the efforts.

The housing and real estate sector in India witnessed foreign direct investment (FDI) of $2.8 billion in the fiscal year (April-March) 2009-10, according to Indian Department of Industrial Policy and Promotion. The statistics made available to the media at the India Home property exhibition, which concluded in Dubai on Sunday, revealed that total NRI FDI inflows through the period April-December 2009-10 stood at $320.05 million.