Realtor may be barred for altering financial conditions

The finance ministry has asked the central bank to bar real estate firms from seeking banking licences and alter conditions relating to financial inclusion and stake dilution by promoters.

The finance ministry has asked the central bank to bar real estate firms from seeking banking licences and alter conditions relating to financial inclusion and stake dilution by promoters.

Chennai-based real estate developer True Value Homes is planning to invest Rs.800 crore over the next three years to develop around 12 projects, majority of which will be in the residential segment.

Real estate has emerged as the most preferred investment avenue for working professionals in non-metro centres vis-à-vis bullion and stock market.

Real estate developers are trying to change perceptions. A new team of office bearers which took charge at the Confederation of Real Estate Developers’ Associations of India (CREDAI) has announced to work on a set of measures that will help builders deliver projects on time, redress customer grievances and improve governance to change image and perception of the sector.

Real Estate developers across the country have termed the Union Budget 2011-12 as a tie cricket match which can’t be termed as won or lost. However, they are all unanimous that it is not a game changer budget for the sector.

Omaxe Ltd., the real estate and infrastructure development company has reported Consolidated Net Sales of Rs. 347.97 crore for the quarter ended December 31st 2010 as compared to Rs. 280.20 crore for the quarter ended December 31st 2009, registering a growth of 24.2%.

Vascon Engineers Ltd, a Real Estate and EPC company, on a consolidated basis recorded a revenue of Rs. 215.82 crore for Q3FY11 as against Rs.158.60 crore in the corresponding quarter last year; marking a growth of 36.08%.

The Confederation of Real Developers Association of India has said the Government could consider a scheme along the lines of the First-Time Home Buyer Tax Credit allowed in the US with the benefits going directly to the consumer.

Value and Affordable housing remains a segment where government should definitely continue to provide developers with tax free status which was available earlier. Rather than restricting it to unit sizes as in the past of 1,000 / 1,500 sft per housing unit, the government could instead have a maximum per unit value of say Rs. 15 lakhs for units near Tier I Cities, Rs. 10 lakhs for Tier II Cities.

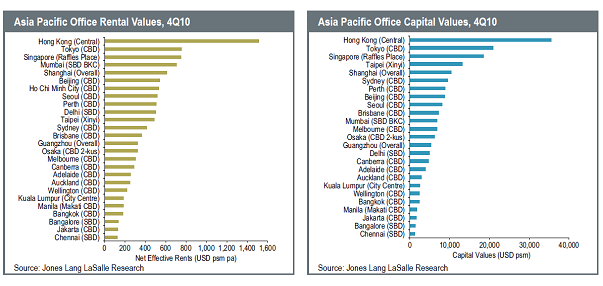

New research from Jones Lang LaSalle reveals that positive business sentiment and solid corporate hiring are buoying leasing demand in the office markets of Asia Pacific. In 2010, aggregate net take-up across major Tier I markets was more than double the level of the previous year.