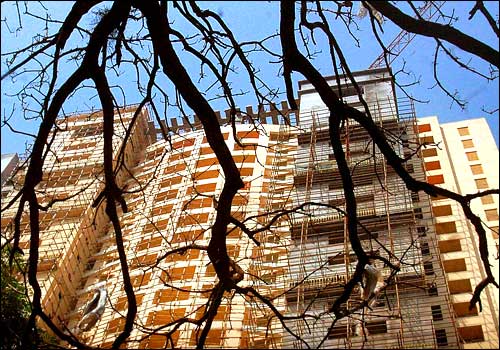

Property prices to remain range bound for H1 CY12: Makaan.com

The year 2011 can best be described as a lackluster year for Indian real estate sector. There were several headwinds that prevented the sector from delivering to its full potential.

The year 2011 can best be described as a lackluster year for Indian real estate sector. There were several headwinds that prevented the sector from delivering to its full potential.

Raids by income tax sleuths on the offices of realty firm M3M recently yielded Rs.314 crore unaccounted income.

Finance is a branch of economics that deals with the management of money and other assets.

Buying an office or retail space is a huge investment, which is why commercial real estate has been traditionally seen as an asset class that only institutional investors or heavyweight HNIs could invest in.

Investigating the Adarsh scame in Mumbai the CBI and Income Tax department unearthed the unholy nexus between the then Chief Minister Ashok Chavan and his Mumbai Commissioner of Police (Traffic) termed as Traffic CP Sanjay Burve.

CB Richard Ellis Group Inc., the commercial real estate services company has reported first quarter 2011 revenues of $1.2 billion compared with $1.0 billion in the year-earlier quarter, reflecting an increase of 16%.

Ascendas India Development Trust (AIDT), the India-focused real estate fund floated by Singapore-based office space developer, is looking to raise close to $350 million.

The Income-Tax department is planning to look into all suspected real estate deals to check involvement of black money component and tax evasion.

The Sensex has always been a barometer of the country’s general economic ‘mood’. The real estate index, on the other hand, is an indicator of the sentiments towards real estate developers.

Income-Tax officials raided the offices and residences of real estate czar, Century Group owned by P Dayanand Pai and Satish Pai, and Manipal University managed by the Pais.