SEBI issues public notice alerting against Sahara Group

Capital markets regulator Securities and Exchange Board of India (SEBI) on Friday issued a public notice alerting investors about a ban on money mobilization by two Sahara group firms.

Capital markets regulator Securities and Exchange Board of India (SEBI) on Friday issued a public notice alerting investors about a ban on money mobilization by two Sahara group firms.

Sahara Housing Investment Corp. Ltd and Sahara India Real Estate Corp. Ltd, two firms that are part of the diversified Sahara India Pariwar group, continue to raise money from the public, defying a ban on such activity by capital market regulator Securities and Exchange Board of India (SEBI).

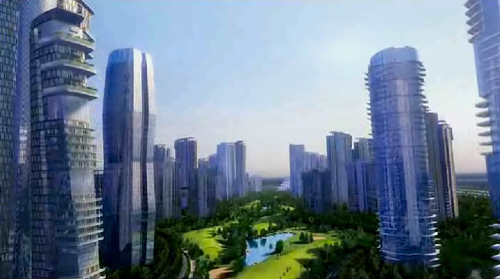

Central Business Districts (CBDs) are supposed to be the lifeline of the city and a mirror of the economic activity and real estate market trend.

Mall management is a huge movement in more developed and matured markets, especially where the mall culture has evolved significantly.

Realty firms are making a beeline to private equity investors for money to repay mounting debt portfolios. With commercial banks turning cautious about lending to the real estate sector, industry players strapped for cash are seeking equity capital to ease the liquidity crunch.

The chargesheet has been filed by the CBI against former telecom minister A Raja in the 2G spectrum scam with the leading real estate company Unitech and two others being a party to the criminal conspiracy, forgery, cheating and corruption.

Banks have experienced strong demand for loans from the real estate sector and non-banking finance companies (NBFCs) during the year till February, shows the latest data released by the Reserve Bank of India.

When the leading real estate company DLF sold 1250 flats within 2 hours of launch in 2009, there were many eyebrows raised. After all, in a market that was weathering crisis of confidence and liquidity it was hard to believe in the first place.

The Income Tax department has sent notices to real estate companies, MMRDA, CIDCO stating that all land lease sales or transfers attract a 10% tax, sources said.

This week has been a good one for investors in real estate shares, who had seen their investments lose 30%-55% in value over the past six months in the wake of a number of corruption allegations involving the sector.