Cushman & Wakefield sets up office in Ahmedabad

Cushman & Wakefield has opened its new office in Ahmedabad…

Cushman & Wakefield has opened its new office in Ahmedabad…

Beyond what is happening in the strategic board room meetings of realty companies, market is cautiously optimistic that with the inventories piling up, developers will sooner or later be forced to blink. A look at the recent developments in the sector does indicate that prices can come down, but it all depends on the builders holding power.

Leasing of prime office space across key cities in India witnessed an increase in the second quarter of 2012 with over 7 million sq.ft. of office space being absorbed across key cities.

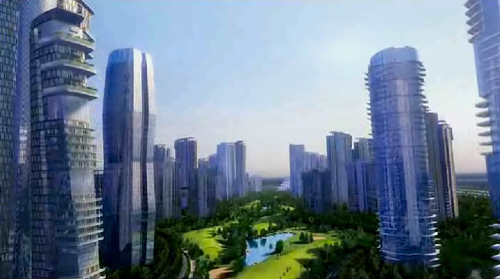

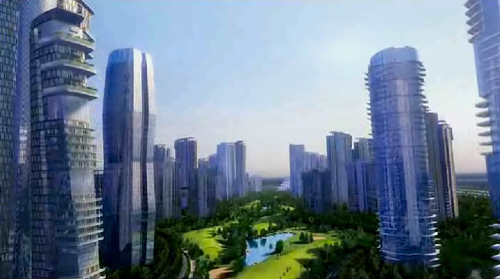

Till the ‘90s and even early years of the last decade, commercial real estate was being built as just another asset class to be leased out to entrepreneurs who would start or expand business as and when required. Most office buildings were largely built in the central business districts of various cities, functioning primarily as the central node where most of the commercial activity of the city took place.

The unprecedented restructuring of project portfolio, selling of land bank, exiting non-core business and the job cuts have yet not led the Indian real estate into the desired comfort zone. The realization to shed the flab has on the contrary left some of the developers to outsource the project execution and pay more.

The Indian strategy in the hospitality segment seems to be borne out of the demand-supply market dynamics. An industry survey estimates that the three major Indian metropolitan areas—Bangalore, Mumbai and Delhi—command some of the highest hotel rentals in the world.

During the boom, many developers dreamed of transforming the urban landscape with millions of square feet of homes, offices and malls and set off on an aggressive expansion financed with debt that at 6 percent interest was cheap by Indian standards.

Realty sector may appear to be bullish and project that downside is over with rosy forecast ahead, yet the decline in fortune is far from being over. As a matter of fact, the learning in the last four years has made most of the leading players to restructure their project portfolio and shed the flab.

Below the line marketing company Theme Ventures has signed a group of well-known real estate companies in Mumbai to sell the residential properties directly to the corporate employees by setting up shops inside the large work premises, the news reports said.

In the wake of the Competition Commission of India (CCI) imposing a hefty penalty of Rs. 630 crore on DLF, the anti-monopoly regulator has been flooded with a host of real estate related consumer complaints which may not be in the ambit of CCI. CCI should draw a line that bifurcates between what falls in its domain and what is in the consumer protection ambit. However, in the absence of scientific economic analysis of the relevant market, both in product category and geographic category, the two legs of the relevant market, the sector is keeping its fingers crossed as there has been a clear anomaly in defining the relevant market by the CCI.