Realtors have been adding Rs14 crore debt a day

The debt load of 11 listed real estate companies in the country has risen 15%, or by Rs.5,000 crore, to Rs.38,500 crore in the last 12 months.

The debt load of 11 listed real estate companies in the country has risen 15%, or by Rs.5,000 crore, to Rs.38,500 crore in the last 12 months.

DLF plans to reduce its debt by Rs.2,500-3,000 crore by the end of this financial year, according to Group Executive Director Rajeev Talwar.

Rakesh Jain booked a flat in one of the projects in Noida Extension. He paid to the developer all the savings from his hard-earned money and had everything in place-due diligence done through his lawyer.

The Competition Commission of India (CCI) has slapped a 630-crore fine on DLF, threatening to turn an isolated dispute between flat buyers and India’s largest builder into a full-blown headache for the industry.

An increasing number of Indian nationals working in Singapore are investing in properties in India and other countries, like Malaysia, London, Australia, Thailand and Singapore, according to a local media report.

Targeted developers for new building technology created by International Steel Structures (ISS) to be showcased in India were announced by Global Housing Alliance (GHA), the company in charge of licensing the technology.

Ascott, one of the world’s largest serviced residence owner-operator, is expanding its footprint in India in cities like Mumbai, Delhi and Pune, adding to its $250 million investment in seven upcoming properties.

DLF on Tuesday, August 2, reported a 12.81 per cent decline in its consolidated net profit for the first quarter ended June 30 at Rs.358.36 crore.

An analysis of the recent revival of commercial real estate market in Mumbai shows that the Banking, Financial Services and Insurance (BFSI) sector has been primarily responsible for the huge uptake of office space.

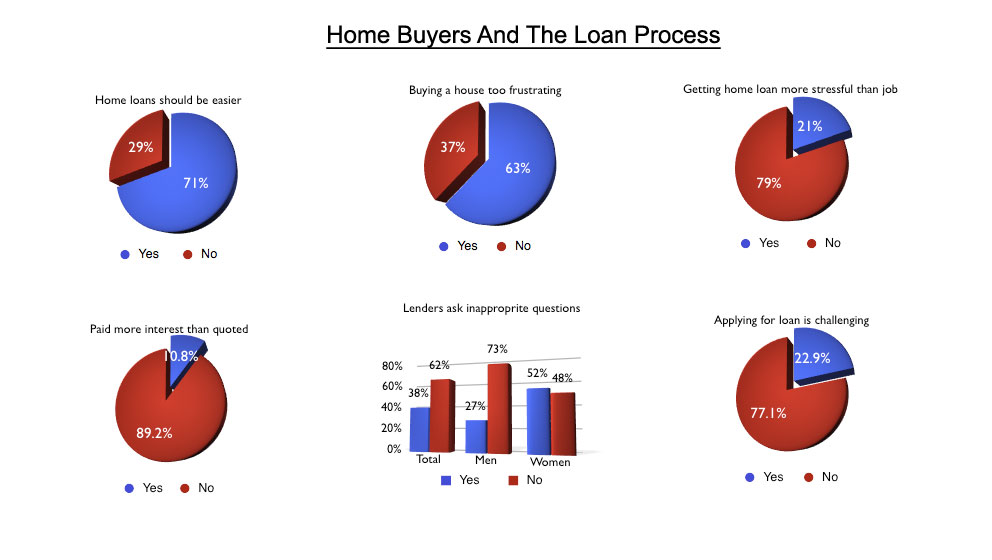

While buying a house two out of three Indians (70.6%) demand a simpler, more understandable home loan procedure.