Impact of Tohoku earthquake over Tokyo office market

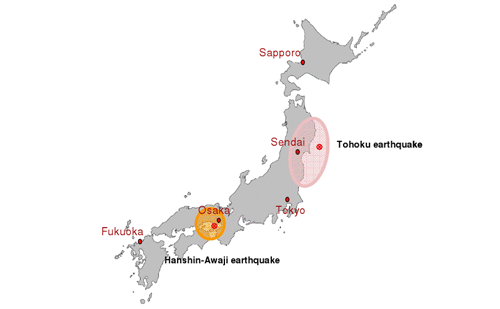

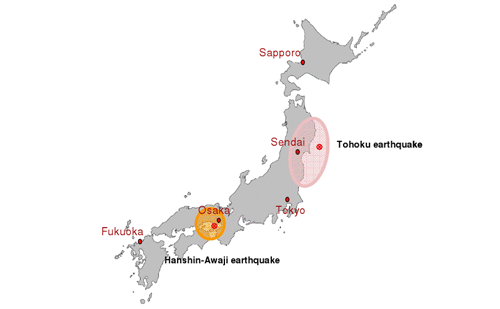

On 11 March, a major earthquake and tsunami hit Eastern Japan. According to official statistics, the number of deceased had surpassed 13,000 as at 14 April.

On 11 March, a major earthquake and tsunami hit Eastern Japan. According to official statistics, the number of deceased had surpassed 13,000 as at 14 April.

Urbanization rate is on the increase – and while there had been a few setbacks over the past few years, the Indian luxury retail market is firmly back now. The economy once again supports the rationale for spending on luxury goods, and it will continue to do so.

The Fitch Ratings 2011 outlook for the Indian real estate sector seems to contradict itself. While it says the realty market is stable in the year, it also warns of a negative bias. The negative forecast of Fitch Ratings is, however, based more on the sentiments than the emerging market reality.

Jones Lang LaSalle, in conjunction with Blake Dawson, has produced its first Asia Pacific Property Investment Guide. Asia Pacific has a wide range of real estate markets – each with distinctive rules for investors. The guide covers important issues that investors need to consider when investing in real estate around the region.

On being asked about the vicious cycle of trust deficit in property market, a Dubai RERA member interrupts me. He asserts there is instead a virtuous cycle of trust; something that has goaded nationals of 100 plus countries to invest in the emirates. The reality is that Dubai property market was no different than the Indian real estate till 2008. What changed Dubai property market and where India can learn from emirates is in setting up fast track courts. A Track2Realty report.

It’s not that I don’t stand with the builders where the support is due on principled ground. I can easily recall how in the year 2017 I had to stand by a builder who was being harassed by the powerful CEO of a powerful development body. The bureaucrat had demanded one apartment, and denial led to bulldozing over the project boundary walls much after grant of OC & CC. As a journalist, I was with the builder for a sting operation and also sent him to a couple of TV news channels to air his grievances. The officer’s troll army had a field day against me, but I stood my ground till the bureaucrat was transferred. Will an anti-builder journalist do that?

When I said it in one of the podcasts that it is better to buy a Ready to Move apartment as it is never a costly proposition, as perceived by the home buyers at large. Compared to Under Construction, a Ready to Move apartment is loaded with execution assurance, peace of mind, and almost no additional financial burden. Ever since that I was flooded with very many queries to elaborate on the same. The questions are being raised by not just the critics within the built environment of Indian real estate this time who love to hate my critical take on the sector. A number of concerned home buyers too asked me in the comment section of the podcast to delve deeper for their better understanding.

The recent correction of Indian stock market has reignited the age-old debate of real estate versus stock market. In the last few weeks I am asked at various forum, it’s rather bombardment of arguments, why I don’t accept the reality of property market being a safer bet with lesser volatility. A little bit of correction in stock market makes every stakeholders & influencers of property cite it as to how property is the safest asset class. All that I can say is that I am amused with the logic, or rather lack of it.

In a landmark judgment the Supreme Court has said that the builders can now only deduct up to 10% of the base price for cancellations. A bench of Justice B R Gavai and S V N Bhatt said that the contractual terms which are one-sided, unfair and unreasonable can not be enforced and would constitute unfair trade practice. Unfortunately, the judgment has not been delivered against any small-time builder, but the corporate conglomerate Godrej Properties, which argued that it should be allowed to forfeit 20% of the amount as per agreement with the buyer. Track2Realty finds there are even larger questions that remained unanswered about builders’ arbitrary cancellations, forfeit of money and unfair contract.

In a landmark judgment with far reaching consequences, Bihar RERA has issues arrest warrant against three builders. This could easily be termed as a historic judgment of RERA. Why so? It is because the eco system of the complex business of Indian real estate has been such that builders continue to take RERA for granted. For the large universe of erring builders, RERA stands out as another window of litigation that only helps them to prolong the buyers legal fight without any accountability, forget about fear of the regulation called RERA.