The availability of skilled manpower supported by availability of cost effective commercial real estate – especially in terms of Grade A projects – continues to drive demand for office properties in Pune.

The availability of skilled manpower supported by availability of cost effective commercial real estate – especially in terms of Grade A projects – continues to drive demand for office properties in Pune.

Despite the strong probability of correction of residential property prices…

Both the economy and the residential property sector are currently in a state of uncertainty. This has resulted in a rather prolonged period of vacillation and hesitancy among home buyers in India.

Both absorption and leasing activity remained robust in Pune in 1H11. Net overall absorption was 2.3 million sq ft (213,591 sqm), with 1.5 million sq ft leased during 2Q11.

Leasing activity continued to remain strong in suburban micro-markets of Delhi – NCR, while the CBD and SBD saw moderate activity.

India is rapidly urbanizing, not only in form and features but, from within.

With government support and increase in number of real estate developers, affordable housing demand will surge at a CAGR of around 13% during 2011-2013, says a research report by RNCOS a thinktank group on industry intelligence and creative solutions for contemporary business segments.

As Central Business Districts (CBD) begin to gradually lose their sheen against alternative locations because of their inability to offer Grade A buildings at competitive rates, retrofitting emerges as a preferred option (as compared with redevelopment) for quality improvement to increase the attractiveness and economic life of existing old buildings.

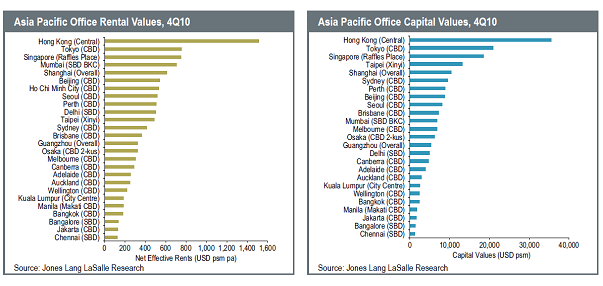

New research from Jones Lang LaSalle reveals that positive business sentiment and solid corporate hiring are buoying leasing demand in the office markets of Asia Pacific. In 2010, aggregate net take-up across major Tier I markets was more than double the level of the previous year.

Mumbai witnessed the highest absorption in the year in 4Q10 which was recorded at 1,328,582 sq ft (123,429 sqm) indicating robust demand. Demand for Grade A office space was broad-based and not restricted to the banking, financial services and insurance (BFSI) sectors, which typically dominate Mumbai’s tenant landscape. Domestic and multinational occupiers from the consulting, aviation, IT/ITES and other industries were active in acquiring front-office and back-office space in 4Q10.