Main header for policy news section

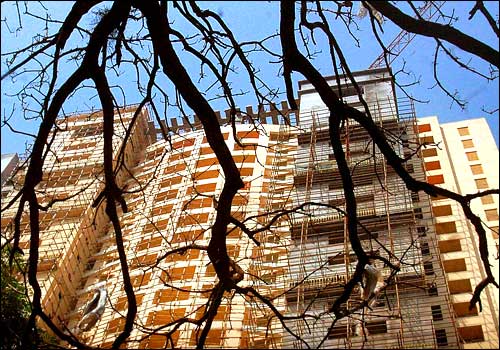

Terming stamp duties as a “big obstacle” in ensuring transparent transactions in real estate, Prime Minister Manmohan Singh on Friday batted for reducing such levies to check the flow of black money in the sector.