Track2Realty: Opposing the Maharashtra government’s decision to hike stamp duty and other taxes related to property, CREDAI has cautioned against capital flight from the State to neighbouring Gujarat and even to Jakarta.

Track2Realty: Opposing the Maharashtra government’s decision to hike stamp duty and other taxes related to property, CREDAI has cautioned against capital flight from the State to neighbouring Gujarat and even to Jakarta.

Track2Realty: The National Real Estate Development Council (NAREDCO) has requested the government to extend the computation period for availing itself of income tax benefits by one more year. This period is going to end on March 31, 2013.

Track2Realty-Agencies: To provide cheaper houses for lower income groups, the Ministry of Housing and Urban Poverty Alleviation (HUPA) is working for the inclusion of affordable housing in the infrastructure list.

Track2Realty-Agencies: Foreign investors are being cautious about the Indian real estate market because it fails to meet the global standards, says Sean Tompkins, global Chief Executive Officer of UK-based Royal Institution of Chartered Surveyors (RICS).

Track2Realty: The Punjab Deputy Chief Minister Sukhbir Singh Badal showcased on Saturday, Nov 17, prime urban land under the possession of Punjab Government to 137 international and national Real Estate Developers, who assembled in Mumbai under the aegis of Confederation of Real Estate Developers’ Association of India (CREDAI) in a convention organized by them, Punjab land of opportunities.

Track2Realty: In terms of planned urban growth, the evidence for real estate development being backed by the creation of associated physical infrastructure is higher in Noida and Greater Noida. Gurgaon and Faridabad are at the opposite spectrum, where infrastructure is developed after the real estate potential of an area has been nearly fully exploited. In other words, infrastructure projects in these areas is largely taken up only after an area is already primed for real estate growth. Even so, Gurgaon has seen the maximum capital appreciation for investors and end users.

Track2Realty-Agencies: Ironic it may sound, but the developers are getting hurt by allegations of corruption in the realty sector. Confederation of Real Estate Developers’ Association of India (CREDAI) has asked its about 10,000 members not to pay bribe to officials for getting project clearance.

Track2Realty: In cases where zoning laws and the co-operative housing society in question permit it, there can be cases where running a business from home is viable. Doing so can save on the cost of renting or purchasing a commercial space. It also saves on the cost of commuting to and from work as well as on many operational costs.

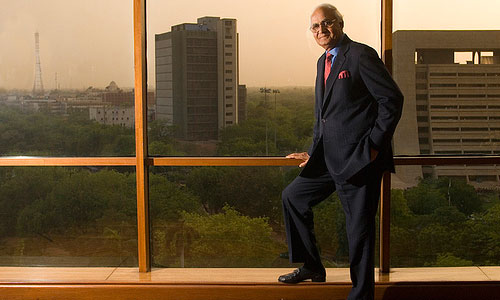

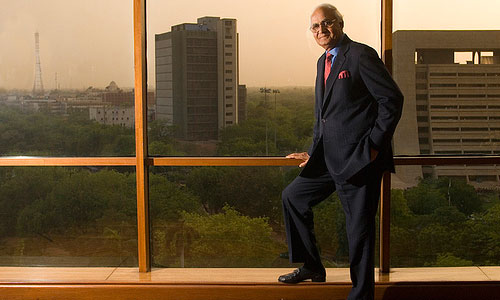

DLF Chairman K P Singh has warned that the current policy paralysis has had an adverse impact on the country’s growth momentum denting business confidence, and could lead to its unique demographic dividend turning into a demographic nightmare.

DLF’s Chairman K P Singh has said that RBI’s monetary policy should not stunt the growth of real estate sector and uninterrupted access to affordable finance is vital for this business.