Supreme Court dismisses Sahara plea against SEBI

SEBI can examine financial instruments used by two companies of the Sahara Group to raise money from the public after India’s top court dismissed its petitions on Thursday.

SEBI can examine financial instruments used by two companies of the Sahara Group to raise money from the public after India’s top court dismissed its petitions on Thursday.

It fair to say that current property development status is very different from previous ones.

Sahara group companies, which raised Rs.4,843 crore by issuing optionally fully convertible debentures (OFCDs), is not using its own bank account to handle this money.

The contour of the Real Estate Draft Bill has been changed to make it a central legislation, a shift from it being a state matter earlier.

Despite the continuing turbulence and uncertainty in other parts of the globe, two economies – India and China – will continue to grow at an annual rate of 8-10%.

The National Housing Bank (NHB) and Indian Banks’ Association (IBA) are jointly preparing the norms, standards and procedures for real estate valuation.

For those searching for their home sweet home in Goa, there’s a treat in store this Akshaya Tritaya.

While everybody, including the Finance Minister seems to be focussing on the affordable housing, the definition of the real estate at the bottom of the pyramid seems to be changing.

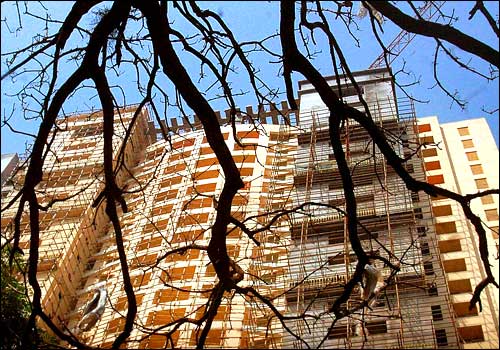

Investigating the Adarsh scame in Mumbai the CBI and Income Tax department unearthed the unholy nexus between the then Chief Minister Ashok Chavan and his Mumbai Commissioner of Police (Traffic) termed as Traffic CP Sanjay Burve.

The Sahara-Securities and Exchange Board of India (SEBI) legal battle seems to be heading to a verdict now.