Spencer’s eyes foreign ties

Spencer’s has initiated stake sale talks with a foreign retailer on hopes that foreign direct investment will be opened up in multi-brand retail.

Spencer’s has initiated stake sale talks with a foreign retailer on hopes that foreign direct investment will be opened up in multi-brand retail.

The Confederation of Real Estate Developers’ Association of India (CREDAI) has estimated that the sector will face a funding gap to the tune of USD 70 billion over the next five years.

Two marquee international brands — Giorgio Armani and Ferragamo — that have joint ventures with leading realty player DLF group’s subsidiary, DLF Brands, have been talking to other corporate groups and investors to scope out the potential of changing their Indian partner.

Land acquisition has become a very contentious issue these days. There are some states where land acquisition has evoked public protest and at some places these are politically motivated as well.

Newspaper advertisements and other branding collaterals of some of the real estate projects across the country attract the eye balls for what Indians have always aspired for—International living.

Indian arm of a leading Bangkok based developer is looking to invest some $300 million in the country’s real estate market, particularly in the major cities of Delhi, Mumbai and Bangalore.

Demand for residential development will continue to remain unabated, but the requirement of real estate by retail industry over the next five years and even thereafter will provide a major thrust to the property market in India, said CB Richard Ellis’ global president Robert E Sulentic.

Central Business Districts (CBDs) are supposed to be the lifeline of the city and a mirror of the economic activity and real estate market trend.

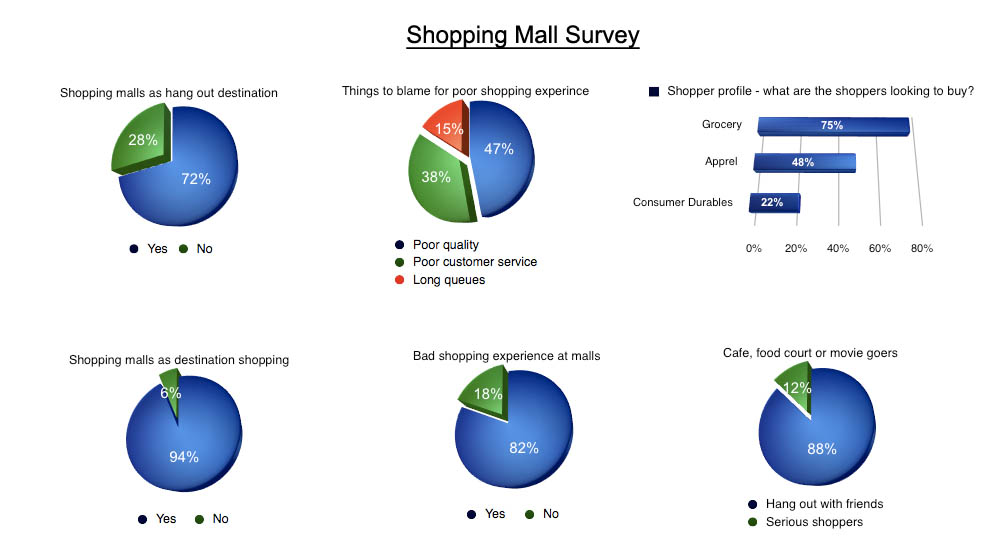

As many as seven out of 10 Indians with disposal income, a whopping 72 per cent, go to shopping malls at least twice a month but don’t buy the monthly food & grocery, apparels or consumer durables over there.

Indian house prices rose rapidly from 2002 to 2007. Strong economic growth and urbanization supported house prices, while in city centres a housing bubble was encouraged by inadequate infrastructure, lack of planning and antiquated land use laws.