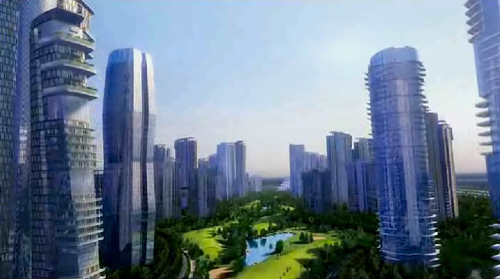

NCR residential development: New Gurgaon and Dwarka Expressway

The stretch called New Gurgaon is the closest in terms of proximity to Dwarka and West Delhi once the Dwarka Expressway is operational.

The stretch called New Gurgaon is the closest in terms of proximity to Dwarka and West Delhi once the Dwarka Expressway is operational.

Realty firms are making a beeline to private equity investors for money to repay mounting debt portfolios. With commercial banks turning cautious about lending to the real estate sector, industry players strapped for cash are seeking equity capital to ease the liquidity crunch.

While the foreign direct investment flows (FDI) dependent Indian realty market is awaiting a good fortune, a World Bank report brings cheer to the industry. It says the FDI into developing countries including India is expected to recover over the next couple of years and is projected to increase by 17 per cent in 2010.

Confusing it may sound, but a project called Delhi One has been launched in Noida by the trend setter of green building concept in India The 3C Company. This mega mixed-use project incorporating residential, commercial, retail and hospitality zones is spread across 12.5 acres at Sector 16-B, Noida.

Such misleading claims prima facie give an impression that the property market in the Indian cities in general, and Delhi-NCR in particular, have peaked up on the eve of long festive season ahead. The claims nevertheless raise more questions than could answer as to how and why there has been sudden spurt in the sales velocity.

RERA is one year old now and already the homebuyers are questioning the legislation, in the absence of any visible changes on the ground. The developers, on the contrary, feel RERA has already identified the challenges and hit the nail. Within the built environment the debate is inconclusive as to what extent RERA has brought in transparency and accountability and to what extent has it enhanced homebuyer confidence.

Track2Realty Exclusive: How realistic is the reported appreciation of property in a market where the buyers are unable to exit at even half the reported appreciation figure? Track2Realty Focus tries to decode the mystery of property appreciation to unveil the worst kept secret of the business.

The surge in demand for luxury housing has been primarily attributable to a growing preference among affluent buyers for enhanced amenities and more spacious living areas that complement their multifaceted lifestyles. Moreover, the increasing aspirational class has significantly contributed to the increased demand for luxury properties. Furthermore, the rise in NRI and astute domestic investors in the Indian real estate market has considerably fueled the heightened demand for luxury residences.

The real estate market of Goa is also expanding not only in terms of buyer interest but also geographically. The once-limited property market is now spreading across new areas, offering a wider variety of options to buyers. Alongside this expansion, there has been a notable rise in property prices. What was once a market catering to properties valued between Rs 5 crore and Rs 15 crore has evolved, with some villas now fetching prices of up to Rs 100 crore. This surge reflects the growing interest from ultra-high-net-worth individuals who are seeking exclusive, luxury homes in the region.

Positioned close to major attractions such as Yashobhoomi (Asia’s largest convention center), IGI Airport (ranked among the world’s top 10 airports), Bharat Vandana Park (spanning 200 acres and one of Delhi’s largest parks, akin to Hyde Park and Central Park), and the upcoming diplomatic enclave with 39 embassies, the project is set to capture significant visitor traffic. The nearby Metrolite light rail system will further enhance accessibility. The project is expected to be completed by 2027 and to generate over Rs 4,200 crore in revenue during its lifecycle.