JLL Asia Pacific property digest: Pune – Q2, 2011

Both absorption and leasing activity remained robust in Pune in 1H11. Net overall absorption was 2.3 million sq ft (213,591 sqm), with 1.5 million sq ft leased during 2Q11.

Both absorption and leasing activity remained robust in Pune in 1H11. Net overall absorption was 2.3 million sq ft (213,591 sqm), with 1.5 million sq ft leased during 2Q11.

Ongoing corporate hiring and expanding accommodation requirements underpinned the Asia Pacific office leasing market in 2Q11, according to new research from Jones Lang LaSalle in their recent Asia Pacific Office Index.

Demand continued to be robust in Bangalore with corporates expanding and leasing large spaces.

Leasing activity continued to remain strong in suburban micro-markets of Delhi – NCR, while the CBD and SBD saw moderate activity.

Jones Lang LaSalle has been named ‘Best Property Consultancy’ in Asia Pacific at ‘The Asia Pacific Property Awards 2011 in association with Bloomberg Television’ event held in Shanghai on Tuesday.

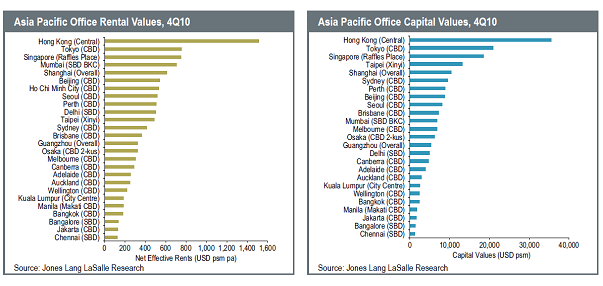

New research from Jones Lang LaSalle reveals that positive business sentiment and solid corporate hiring are buoying leasing demand in the office markets of Asia Pacific. In 2010, aggregate net take-up across major Tier I markets was more than double the level of the previous year.

Mumbai witnessed the highest absorption in the year in 4Q10 which was recorded at 1,328,582 sq ft (123,429 sqm) indicating robust demand. Demand for Grade A office space was broad-based and not restricted to the banking, financial services and insurance (BFSI) sectors, which typically dominate Mumbai’s tenant landscape. Domestic and multinational occupiers from the consulting, aviation, IT/ITES and other industries were active in acquiring front-office and back-office space in 4Q10.

The Hyderabad commercial office market posted a strong increase in demand in 2010 with the foray of new occupiers such as United Health Group, JP Morgan Chase and Facebook, and the expansion of existing tenants including TCS, Accenture, Google, Mindtree and Cognizant. Majority of the leasing transactions were recorded in the peripheral districts of Hitec City and Gachibowli. During the year, the city also witnessed strong pre-leasing activity. Demand of SEZ space in the city increased as compared to IT Parks in 2010.

The period ending 4Q10 witnessed low to moderate activity levels in the CBD and SBD of Delhi NCR. The CBD, with its low vacancy levels, continued to cater to small office queries, while the SBD with significantly more office stock, catered to the larger corporate office space demand.

Bangalore continued to witness increased market activity in 4Q10. Transaction volumes have improved significantly compared to that in the previous quarter. The improvement in transaction activity can be attributed to the stabilising macroeconomic situation, positive business environment outlook and the strengthening domestic market conditions.