Realtors worried over repayment of bank debt

The impending closure of the financial year has the listed real estate developers scurrying to make final repayments or get debt refinanced.

The impending closure of the financial year has the listed real estate developers scurrying to make final repayments or get debt refinanced.

At least four firms, Ansal Properties and Infrastructure Ltd (Ansal API), Emaar MGF Land Ltd, Kumar Urban Development Ltd and Paranjape Schemes Constructions Ltd, have received fresh sanctions from banks, although overall lending to the sector remains subdued.

Century Real Estate Holdings, the realty development arm of three-decade old Bangalore-based Century Group, is looking to raise Rs 700 crore through private equity players in three tranches. The company during the past four years have been focusing on development of projects, is understood to be effecting this deal at the holding company level.

With liquidity from traditional channels like banks and equity markets drying up for property developers, non-banking finance companies (NBFCs) have raised rates for loans to real estate companies by two-three percentage points (200-300 basis points). The rates have gone up from 15-19 per cent to 17-22 per cent. The rates vary according to the developer, the project and the requirement of the company, say NBFCs and consultants.

The Associated Chambers of Commerce and Industry of India (ASSOCHAM) has suggested the government to introduce Real Estate Investment Trust and Real Estate Mutual Fund to enable investors to own a diversified portfolio of professionally managed assets in the real estate sector. In a note submitted to the government, the Chamber said that the Indian Real estate sector currently lacks any monetization vehicle for capital intensive verticals such as commercial offices and retail malls.

The real estate finance advisory has two primary areas of business focus-Capital Structuring Advisory for Local Developers and Strategic Investment Advisory for Capital Investors.

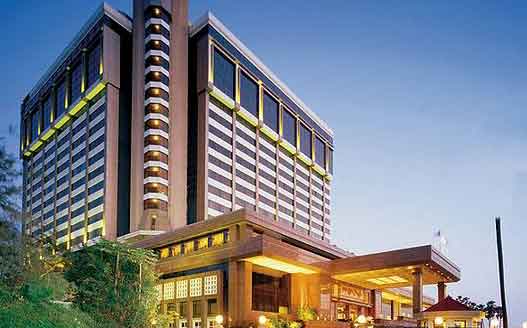

Mumbai is the financial capital of the country. While it is still a far cry from being comparable to Shanghai in terms of aesthetics and infrastructure, the fact remains that most large corporations and financial institutions have their presence in this city.