Bank loans to real estate drops sharply

Banking institutions have cut down on their lending to the real estate sector, according to a report put out on Wednesday by real estate consulting firm Knight Frank India.

Banking institutions have cut down on their lending to the real estate sector, according to a report put out on Wednesday by real estate consulting firm Knight Frank India.

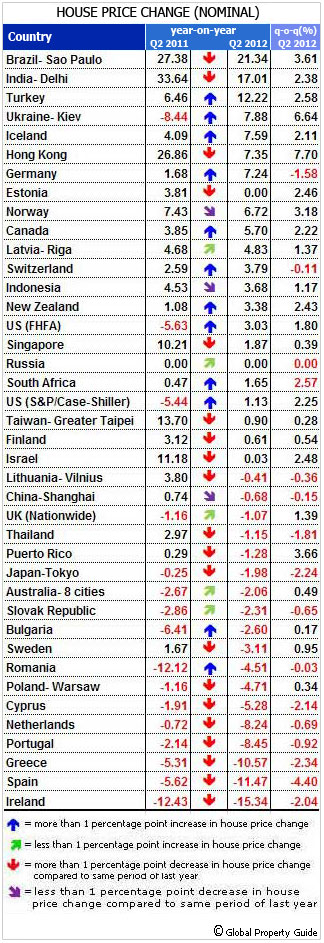

No end to the global housing market downturn is in sight, except probably in the US, according to a survey of global house price trends by the Global Property Guide Asia is weakening, and house price falls in the worst-hit European crisis countries are dramatically accelerating.

The Secretary, Banking, Ministry of Finance has agreed to look into the problems being faced by the real estate industry and work towards reducing the cost of funding through banks and financial institutions.

Despite buyers’ expectations of a likely fall in city property prices, this possibility seems limited as developers continue to hold on to their prices across sub-markets on the back of the DCR amendment. This policy, along with the increase in construction costs, has led to greater pressure on developers’ margins. Post the new DCR, the saleable areas are expected to reduce and carpet areas are likely to increase. It is interesting to note that while there have, in fact, been marginal price increases across many projects in MMR, registration data reflects that absorption levels have also increased.

Does it reflect a disconnect in the luxury housing where demand of high-end units is 16% but supply is as high as 80%? “Not Really.” says Anmol Haval DGM, Sales & Marketing of City Corporation Limited (CCL) which has launched ‘Sweet Water Villas’, an exclusive project of limited edition villas at ‘Amanora’, the first integrated township being developed under the special township policy of Government of Maharashtra.

Various issues plaguing the real estate sector will be discussed at a conclave to be organised here on Friday by Confederation of Indian Industries (CII). The Real Estate Conclave 2012 will be inaugurated by Maharashtra Minister for Housing Sachin Ahir, CII said in a statement.

Anticipating a significant rate cut by the RBI, disappointed real estate community has ring alarm bells and forecast more slump due to the high interest rate regime. Pointing out that the capital and labour intensive sector plays a key role in employment generation and accelerating growth, industry body CREDAI says the government has also been losers of revenue due to neglect of the sector and risks attributed to real estate and the RBI advisories against lending to real estate have only harmed the sector and made housing costlier for consumers, apart from affecting the economy.

Indian real estate companies, which borrowed heavily during the peak of the economic cycle and rosy business forecast, are now caught in the vortex of piling debt post-slowdown. Most of the realtors who went on a land bank acquisition with borrowed money are struggling to repay even the interest and banks look reluctant to restructure the debt any more.

Over the last year, there has been an unequivocal crystallization of Indian cities that continue to attract serious investment into real estate. This is directly correlated to the economic dynamics now working in the country. If India is to achieve even a conservative GDP growth of 6% per year, it emerges that only three cities – Mumbai, Delhi and Bangalore – have the potential to deliver. The reason for this is that close to 2/3rd of the overall development of office space in the country is now taking place in Mumbai, Delhi and Bangalore.

Sachin Sandhir: When the Government talks about affordable housing and expects the developers to do affordable housing, it is a misnomer because the Government is the first perpetuator of price escalation by auctioning the land to the highest bidder. Then to expect the developer to not make a profit of 50-60 per cent or whatever his expectation, is unrealistic.