No end to the global housing market downturn is in sight, except probably in the US, according to a survey of global house price trends by the Global Property Guide Asia is weakening, and house price falls in the worst-hit European crisis countries are dramatically accelerating.

No end to the global housing market downturn is in sight, except probably in the US, according to a survey of global house price trends by the Global Property Guide Asia is weakening, and house price falls in the worst-hit European crisis countries are dramatically accelerating.

Good news: The US housing market seems to be recovering. The Federal Housing Finance Agency’s (FHFA) seasonally adjusted purchase-only house price index in the US rose 1.12% year-on-year in Q2 2012, in sharp contrast with the 8.76% decline during the same period last year. On the other hand, the S&P/Case-Shiller seasonally-adjusted home price index fell by 0.74%, but this was the lowest annual decline since Q3 2010.

Bad news: Europe is sinking deeper. There were alarming price-falls year-on-year in Q2 2012 in Ireland, Spain, Greece, Portugal and the Netherlands (each down more than 10% after inflation). Poland and Cyprus seem also to be slipping into the abyss.

Bad news: Europe is sinking deeper. There were alarming price-falls year-on-year in Q2 2012 in Ireland, Spain, Greece, Portugal and the Netherlands (each down more than 10% after inflation). Poland and Cyprus seem also to be slipping into the abyss.

In the worst-affected European countries, house price declines were significantly greater this year, than during the same period last year. House prices fell in 15 of the 22 European countries for which house price data is available.

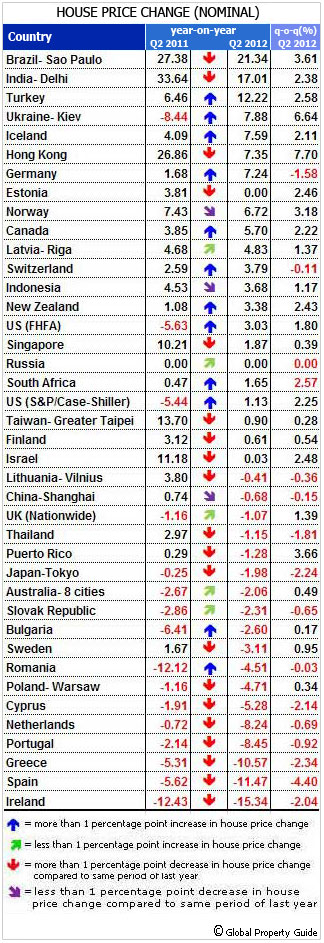

Momentum: 20 housing markets performed more poorly year-on-year in Q2 2012 than in the same period last year, while 19 countries performed better, again in inflation-adjusted terms.

Conclusion: Of the 39 countries for which quarterly house price figures are available, house prices fell in 25 countries, rose in only 13, while one country (the US) posted mixed signals during the year ending in the second quarter of 2012.

Inflation-adjustment: The Global Property Guide’s statistical presentation uses price changes after inflation, giving a more realistic picture than the more upbeat nominal figures usually preferred by real estate agents. Nominal figures can be misleading, as suggested by the fact that year-on-year in Q2, nominal house prices rose in more countries (21 countries) than fell (18 countries).

Q2 2012: Full analysis of world housing market trends

North America – the US recovery is here!

In the United States, the HFA’s seasonally adjusted purchase-only house price index rose 1.12% year-on-year in Q2 2012, in sharp contrast with the 8.76% decline year-on-year in Q2 2011.

US house prices increased 0.96% quarter-on-quarter in Q2, the largest quarterly growth in house prices since Q4 2006, according to FHFA.

The S&P/Case-Shiller seasonally-adjusted home price index fell by 0.74% during the year to Q2 2012, the lowest annual decline since Q3 2010. Quarter-on-quarter, the index rose by 1.41% in Q2 2012.

“Although some housing markets are still facing significant challenges, house prices were quite strong in most areas in the second quarter,” said Andrew Leventis of FHFA. “The strong appreciation may partially reflect fewer homes sold in distress, but declining mortgage rates and a modest supply of homes available for sale likely account for most of the price increase.”

Canada’s housing market has been a strong performer year-on-year in 2012, with house prices in its eleven major cities rising by 4.06% during the year (the same period last year saw a 0.47% rise). House prices rose by 1.59% quarter-on-quarter in Q2 2012, a significant turnaround from quarterly declines of 0.52% in Q1 2012, and 0.2% Q4 2011.

House prices in Canada surged by 62% from Q1 2000 to Q1 2008, and rose by another 18% from Q2 2009 to Q2 2012, despite tighter mortgage and lending regulations imposed by the government.

European housing markets suffering badly

House prices fell in 15 of the 22 European countries for which house price data is available (we cite housing prices for capital or major cities in countries where nationwide data is lacking).

Ireland was again the world’s weakest housing market. Its residential property index plunged 16.85% year-on-year in Q2 2012, and fell by 2.91% in the latest quarter. Transaction volumes were low, and mortgage lending weak.

The next eight weakest housing markets in the world were all in Europe, including Spain (-13.18%) during the year to Q2 2012), Greece (-11.92%), Portugal (-10.95%), Warsaw, Netherlands (-10.12%), Poland (-8.19%), and Cyprus (-7.68%), the Slovak Republic (-5.61%) and Sweden (-4.18%). All except the Slovak Republic saw bigger house price falls this year, than the previous year.

Other European countries and capital cities which saw moderate year-on-year house price falls to Q2 2012 includedBulgaria (-3.87%), the UK (-3.42%), Vilnius, Lithuania (-3.07%), Romania (-2.71%), Finland (-2.22%), and Russia(-2.08%).

European countries and capital cities which enjoyed house price rises included Norway, whose house prices rose 6.26% year-on-year, Germany (up 5.24% – a significant improvement from the decline during the same period last year of 0.65%), Switzerland (4.86%), Estonia (2.83%), Turkey (2.57%), Riga, Latvia (2.5%), and Iceland (1.72%).

Asian housing markets heading down

Asian countries are now feeling the pinch of the global economic downturn.

In Singapore, house prices dropped 3.28% year-on-year in Q2 2012, and by 0.77% during the latest quarter, after a 5.27% increase during the same period last year. The turnaround was due to government housing market curbs, exacerbated by the worldwide economic downturn.

In Thailand, the housing price index for single-detached house including land fell 3.59% during the year to Q2 2012. In Shanghai, China, the second-hand housing price index declined by 3.44% year-on-year in Q2 2012, according to Ehomeday. In Tokyo, Japan, house prices fell 2.18% year-on-year in Q2 2012, in contrast to the 0.18% rise year-on-year in Q2 2011. Likewise, house prices in Taiwan dropped 0.74% year-on-year in Q2 2012, in contrast with the 11.87% rise the previous year. In Indonesia, the residential property price index dropped 0.78% year-on-year in Q2.

In Hong Kong, house prices rose by 3.01% year-on-year in Q2 2012, but this was a sharp slowdown from the 20.64% annual increase during the same period last year.

Housing prices in India rose 6.23% year-on-year in Q2 2012. This was also a sharp slowdown from the 22.7% annual rise during the same period last year. Housing prices fell 1.09% during the latest quarter. The slowdown in the Indian housing market is partly due to its slowing economy.

Sao Paulo, Brazil – the world’s strongest housing market

The best performer in our survey is Sao Paulo, Brazil, where housing prices surged by 15.56% during the year to the second quarter of 2012. However, the momentum is slowing, with Sao Paolo’s housing prices rising only 2.38% in Q2 2012 (FIPE-Zap price index).

The strong performance can partly be attributed to recent stimulus measures by the government, and to the central bank’s rate cut to 8% in July 2012 (a great reduction from 12.5% last year). In addition, Brazil will host the World Cup in 2014, and the Olympics in 2016.

Pacific housing markets up a little

New Zealand’s median house prices rose 2.41% year-on-year in Q2 2012, after a drop of 3.98% during the same period last year. New Zealand’s official cash rate has been kept at 2.5% since March 2011 by the Reserve Bank of New Zealand (RBNZ).

Australia’s housing market is also improving. House prices in the country’s eight major cities were down by 3.2% year-on-year in Q2 2012, an improvement from a decline of 6.05% year-on-year in Q2 2011. House prices fell by just 0.01% quarter-on-quarter in Q2 2012. The Reserve Bank of Australia (RBA) cut the benchmark rate to 3.5% in July 2012, the fourth cut since November 2011.

Israel’s housing market remains weak

In Israel, the average price of owner-occupied housing dropped 1.52% year-on-year in Q2. However, owner-occupied housing prices increased 1.44% during the quarter.

The slowdown in the housing market is mainly due to rising unemployment, to steps taken by the government and the Bank of Israel, and to domestic social unrest over rising cost of living. In addition, worsening global economic uncertainty has not helped.

South Africa’s housing market falling

In South Africa, the price index for medium-sized houses fell by 3.95% during the year to Q2 2012, the sixth consecutive quarter of house price falls, according to ABSA. The country’s housing market is expected to remain subdued, with a slowing economy and domestic social unrest.