Track2Realty Exclusive: Real estate continues to be the best investment instrument of the Indians and it does not seem to be changing in the year ahead. Despite of cribbing, Indians’ investment portfolio will comprise of a house for emotional connect. Return on investments (ROI) also suggests there is no alternative (TINA) to it. However, over reliance on TINA factor may disappoint them in future as it works best in the bull run but is worst indicator of future as well.

Track2Realty Exclusive: Real estate continues to be the best investment instrument of the Indians and it does not seem to be changing in the year ahead. Despite of cribbing, Indians’ investment portfolio will comprise of a house for emotional connect. Return on investments (ROI) also suggests there is no alternative (TINA) to it. However, over reliance on TINA factor may disappoint them in future as it works best in the bull run but is worst indicator of future as well.

If the buyers are so pretty disturbed with the house and if the trust deficit with the real estate is so huge, will real estate continue to be the best investment instrument? Or will gold along with equities bounce back again as the preferred choice in the investment portfolio?

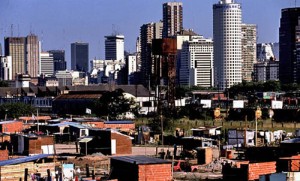

The fact is, as Track2Realty survey respondents also agree, investment in real estate remains the most profitable proposition in India which is growing at a phenomenal pace.

Overall, the returns on long term, say around 15 years, are almost 15 per cent compounded annually. These kinds of returns are hard to come by from any other asset class.

Though critics have it that the prices in metro cities, particularly in Delhi and Mumbai, have gone up very high and any investment at this level would not fetch good returns. But looking at the past records, the high-price level gets evened out and the overall returns remain high in the long term.

To understand the investment pattern, what is more important is to understand the psychograph of the real estate buyers. Is real estate preferred for investment due to TINA (there is no alternative) factor?

Many experts seem to agree with the premise and feel the sense of Déjà vu one gets from hearing about the sustainability of real estate in India raises alarm bells. Every Indian who can afford to buy real estate is loaded up or loading up on the asset. Real estate prices are all time high with appreciation between 100 per cent to 300 per cent over the last five years, despite of overall slowdown in the economy.

Arjun Parthasarthy, Editor of Investor are Idiots says every Indian wants to buy more real estate and gold looking at past returns, which in comparison with equities (flat to negative over a five year period) and debt (around 8% to 8.5% in government run saving schemes) is spectacular.

“Real estate and gold are seen as a hedge against everything possible from inflation to economic slowdown. Real estate and gold has no alternatives and given that there are no alternatives, Indians will keep buying or trying to buy these assets even if prices are unaffordable or unsustainable. The TINA or “There is No Alternative” factor is at work on real estate and gold as investment,” says Pathasarthy.

Rising real estate prices are, however, sowing seeds of doubt in the mind of investors about the future of their proposed investment in property? Many wonder whether the bubble is set to burst and if it is better to wait for prices to fall a little before taking the plunge?

…to be continued