Track2Realty: DLF lost 2.85% to Rs 246.70 at 11:09 IST on BSE after the company after market hours on Thursday, 14 February 2013, reported weak Q3 December 2012 results at operational level.

Track2Realty: DLF lost 2.85% to Rs 246.70 at 11:09 IST on BSE after the company after market hours on Thursday, 14 February 2013, reported weak Q3 December 2012 results at operational level.

Track2Realty: Omaxe has reported nearly 50 per cent increase in consolidated net profit at Rs 28.85 crore in the third quarter of this fiscal.

Track2Realty Exclusive: Come budget and the real estate in the last few years seems to have been repeating the rhetoric of industry status. As a result, year after year it has been a case of realty proposes and the Finance Minister disposes. However, the sector on the eve of 2013-14 makes a strategic shift to be more realistic with its causes and concerns.

Track2Realty: Omaxe Ltd. has launched a Fixed Deposit (FD) Scheme that pays an annualized yield of 15.07% over three years. The company expects to raise Rs 250 crore through this scheme by the end of next financial year.

Track2Realty Exclusive: Kolkata stands out as a case study in land prices suddenly hitting northwards. It has defied the overall slowdown in the real estate sector and exorbitant land prices are pushing housing prices in Kolkata.

Track2Realty-Agencies: Real estate industry and property consultants today hailed the RBI’s decision to cut key policy rates, saying that it is a positive step that would boost housing demand and encourage foreign investment in the sector.

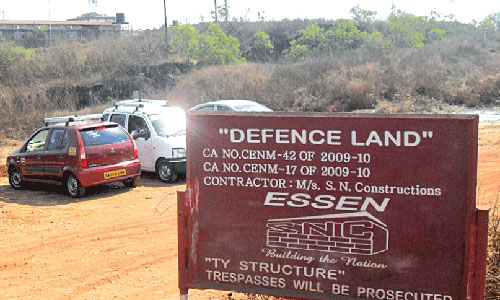

Track2Realty Exclusive: Land as the major input of real estate business is still attracting a premium though land assembling at the cost of project execution has backfired on the fortunes of many realty companies in India.

Track2Realty-Agencies: The Finance Ministry has expressed the view that the Reserve Bank should allow real estate companies and broking firms to set up banks as adequate safeguards will be there to prevent exposure of promoters to related entities.

Track2Realty Exclusive-Yearly Analysis: To say that Indian real estate is standing on a shaky foundation would be like stating the obvious. Pressure is increasingly building on Indian developers. High mortgage rates and the slowest economic growth in nearly a decade are taking a toll on demand. Costs are rising, too. The Price of steel and concrete has jumped to double digit. The pipeline of cash has already dried up.

Track2Realty Exclusive Yearly Analysis: Some analysts believe the economy of the scale in the business is helping the developers to hold the stock. They maintain the developer does not put in his own money in financing a project. Even though the cost of land in cities like Mumbai and Delhi accounts for 70-80 percent of the construction cost, at least 50 per cent of the projects are in joint venture with the land owner.