Mumbai-based RCSPL, which owns group buying portal for real estate GrOffr.com, has acquired Mobstreet.in, a company which was officially shut down in December 2010 due to lack of funds. The acquisition is a cash-cum-stock deal, whose size was undisclosed.

Mumbai-based RCSPL, which owns group buying portal for real estate GrOffr.com, has acquired Mobstreet.in, a company which was officially shut down in December 2010 due to lack of funds. The acquisition is a cash-cum-stock deal, whose size was undisclosed.

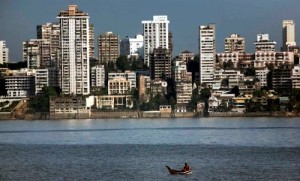

Groffr.com (which stands for ‘Group Offer’) was set up in July 2010 by two IIM-Kozhikode alumni Vikhyat Srivastava and Sandeep Reddy, former analysts with Kotak Mahindra Group. It primarily offers deals in real estate, as well as high ticket services and products including automobiles and electronics such as Blackberrys, diamond jewellery, watches, LED TVs and services such as helicopter rides.

“In the deal we have acquired the customers and the management team of Mobstreet.in,” said Vikhyat Srivastava, co-founder, Groffr.com. The domain name was not useful, but the database of customers matched with Groffr’s user base. Groffr also brought on board Spandan Jasmin Tolia, founder of Mobstreet.in.

Mobstreet.in was set up by Spandan Jasmin Tolia and was one of the many group buying websites that started in 2010 in an attempt to bring global leader Groupon’s model to India. Tolia exited his mutual funds distribution business before starting up Mobstreet. The website suffered challenges of execution and scaling up due to lack of funding. He will now be heading Groffr’s non real estate deals verticals.

Groffr currently employs 16 and has three offices in Bangalore, Mumbai and Hyderabad. It offers real estate deals in these cities and non-real estate deals in Bangalore, Chennai, Goa, Hyderabad, Mumbai, NCR and Pune.

On the company strategy, Srivastava said, “It is a different crowd that we cater to – their average income is Rs.15 lakhs and are between 25-40 years old – they are not college kids. From the beginning, we decided not to do daily deals. Everyone is hooked onto the Groupon story and we were sure we would not go down that route. There is no precedent for us – high value deals are still a niche space and we think it will be complementary to do high value group bookings – not restaurant bookings or hyper local deals”.

The primary lease for a newly launched multi apartment in top cities is already a $400-million market in India. This, according to him, is the opportunity while non-real estate deals will be the cherry on the pie. The group claims to have sold over Rs 100 crore worth of property since inception.